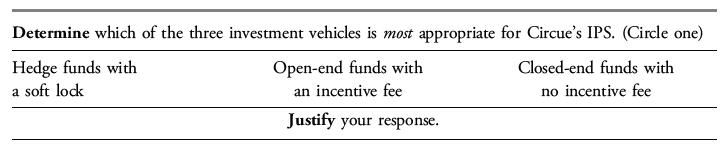

Determine which of the three investment vehicles is most appropriate for Circues IPS. Justify your response. Porter

Question:

Determine which of the three investment vehicles is most appropriate for Circue’s IPS.

Justify your response.

Porter and Smith next consider how the performance-based fee structures of the prospective managers may affect portfolio risk.

Porter states: “I’ve noticed more managers are applying a bonus structure in which the manager is not fully exposed to the downside but is fully exposed to the upside.”

Smith states: “Circue’s current market view is that there are increasing risks to the downside.”

Jack Porter and Melissa Smith are co-managers for the Circue Library Foundation (Circue) in Canada. Within the next six months, Porter and Smith will be replacing one of Circue’s underperforming active managers. This choice will rely on the terms of investment management contracts—specifically, liquidity and management fee structure. Circue’s IPS indicates some tolerance for lower liquidity, a moderate sensitivity to management fees, and a heightened sensitivity to closet indexing.

Circue is considering the following three investment vehicles with distinct fee structures:

• Hedge funds with a soft lock • Open-end funds with an incentive fee • Closed-end funds with no incentive fee

Step by Step Answer: