Of the three attribution approaches referenced by Tolmach, the method requested by the committee: A. is the

Question:

Of the three attribution approaches referenced by Tolmach, the method requested by the committee:

A. is the least accurate.

B. uses the underlying holdings of the actual portfolio.

C. is the most difficult and time consuming to implement.

Stephanie Tolmach is a consultant hired to create a performance attribution report on three funds held by a defined benefit pension plan (the Plan). Fund 1 is a domestic equity strategy, Fund 2 is a global equity strategy, and Fund 3 is a domestic fixed-income strategy.

Tolmach uses three approaches to attribution analysis: the return-based, holdings-based, and transaction-based approaches. The Plan’s investment committee asks Tolmach to (1) apply the attribution method that uses only each fund’s total portfolio returns over the last 12 months to identify return-generating components of the investment process and (2) include the impact of specific active investment decisions and the attribution effects of allocation and security selection in the report.

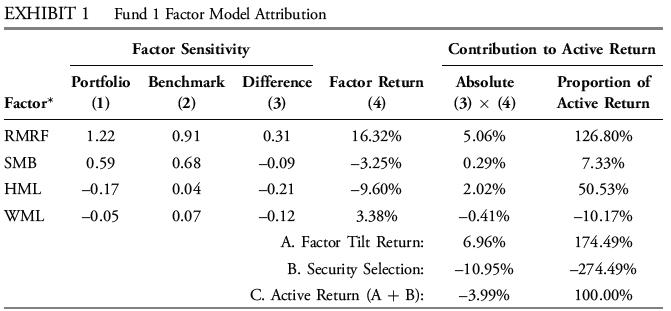

Tolmach first evaluates the performance of Fund 1 by constructing a Carhart factor model; the results are presented in Exhibit 1.

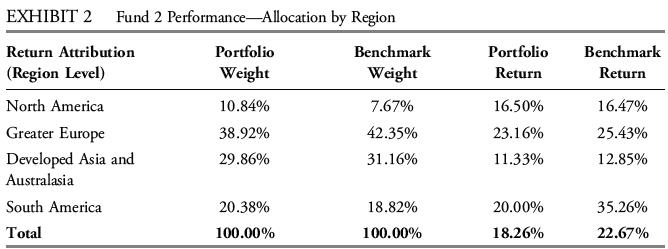

Tolmach turns her attention to Fund 2, constructing a region-based, Brinson–Fachler micro attribution analysis to evaluate the active decisions of the portfolio manager. The results are presented in Exhibit 2.

Next, Tolmach evaluates Fund 3 and the appropriateness of its benchmark. The benchmark is a cap-weighted bond index with daily reported performance; the index is rebalanced frequently, making it difficult to replicate. The benchmark has a meaningful investment in foreign bonds, whereas Fund 3 invests only in domestic bonds.

In the final section of the report, Tolmach reviews the entire Plan’s characteristics, asset allocation, and benchmark. Tolmach observes that the Plan’s benefits are no longer indexed to inflation and that the workforce is, on average, younger than it was when the current fund allocations were approved. Tolmach recommends a change in the Plan’s asset allocation policy.

Step by Step Answer: