The Elmer funds management strategy is: A. active. B. passive. C. blended. Three years ago, the Albright

Question:

The Elmer fund’s management strategy is:

A. active.

B. passive.

C. blended.

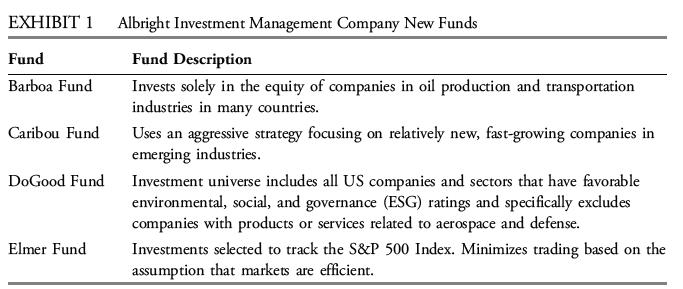

Three years ago, the Albright Investment Management Company (Albright) added four new funds—the Barboa Fund, the Caribou Fund, the DoGood Fund, and the Elmer Fund—to its existing fund offering. Albright’s new funds are described in Exhibit 1.

Hans Smith, an Albright portfolio manager, makes the following notes after examining these funds:

Note 1. The fee on the Caribou Fund is a 15% share of any capital appreciation above a 7% threshold and the use of a high-water mark.

Note 2. The DoGood Fund invests in Fleeker Corporation stock, which is rated high in the ESG space, and Fleeker’s pension fund has a significant investment in the DoGood Fund. This dynamic has the potential for a conflict of interest on the part of Fleeker Corporation but not for the DoGood Fund.

Note 3. The DoGood Fund’s portfolio manager has written policies stating that the fund does not engage in shareholder activism. Therefore, the DoGood Fund may be a free-rider on the activism by these shareholders.

Note 4. Of the four funds, the Elmer Fund is most likely to appeal to investors who want to minimize fees and believe that the market is efficient.

Note 5. Adding investment-grade bonds to the Elmer Fund will decrease the portfolio’s short-term risk.

Smith discusses means of enhancing income for the three funds with the junior analyst, Kolton Frey, including engaging in securities lending or writing covered calls. Frey tells Smith the following:

Statement 1. Securities lending would increase income through reinvestment of the cash collateral but would require the fund to miss out on dividend income from the lent securities.

Statement 2. Writing covered calls would generate income, but doing so would limit the upside share price appreciation for the underlying shares.

Step by Step Answer: