The market-adjusted cost in basis points for the sell order of West Commerce shares is closest to

Question:

The market-adjusted cost in basis points for the sell order of West Commerce shares is closest to a:

A. cost of 249 bps.

B. savings of 50 bps.

C. savings of 68 bps.

Michelle Wong is a portfolio manager at Star Wealth Management (SWM), an investment management company whose clients are high-net-worth individuals. Her expertise is in identifying temporarily mispriced equity securities. Wong’s typical day includes meeting with clients, conducting industry and company investment analysis, and preparing trade recommendations.

Music Plus Wong follows the music industry and, specifically, Music Plus. After highly anticipated data about the music industry is released shortly after the market opens for trading, the share price of Music Plus quickly increases to \($15.25\). Wong evaluates the new data as it relates to Music Plus and concludes that the share price increase is an overreaction. She expects the price to quickly revert back to her revised fair value estimate of \($14.20\) within the same day. When the price is \($15.22\), she decides to prepare a large sell order equal to approximately 20% of the expected daily volume. She is concerned about information leakage from a public limit order.

Wong’s supervisor suggests using algorithmic trading for the sell order of the Music Plus shares.

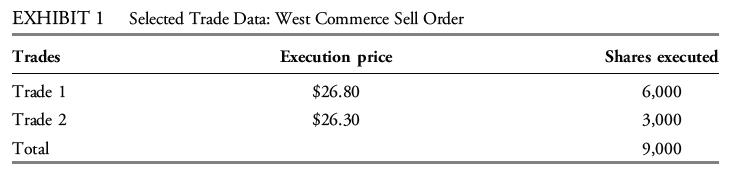

West Commerce Later the same day, West Commerce announces exciting new initiatives resulting in a substantial increase in its share price to \($27.10\). Based on this price, Wong concludes that the stock is overvalued and sets a limit price of \($26.20\) for a sell order of 10,000 shares. By the time the order is released to the market, the share price is \($26.90\). The share price closes the day at \($26.00\). SWM is charged a commission of \($0.03\) per share and no other fees. Selected data about the trade execution are presented in Exhibit 1.

The value of the market index appropriate to West Commerce was 600 when the West Commerce sell order was released to the market, and its volume-weighted average price (VWAP) was 590 during the trade horizon. West Commerce has a beta of 0.9 with the index.

Trading Policies At the end of the day, Wong meets with a long-term client of SWM to discuss SWM’s trade policies. The client identifies two of SWM’s trade policies and asks Wong whether these are consistent with good trade governance:

Policy 1. SWM works only with pre-approved brokers and execution venues, and the list is reviewed and updated regularly.

Policy 2. SWM is allowed to pool funds when appropriate, and executed orders are allocated to the accounts on a pro-rata basis.

Step by Step Answer: