Which fund managers investing approach is most consistent with fundamental management? A. Furlings B. Asgard C. Tokra

Question:

Which fund manager’s investing approach is most consistent with fundamental management?

A. Furlings B. Asgard C. Tokra James Leonard is a fund-of-funds manager with Future Generation, a large sovereign fund.

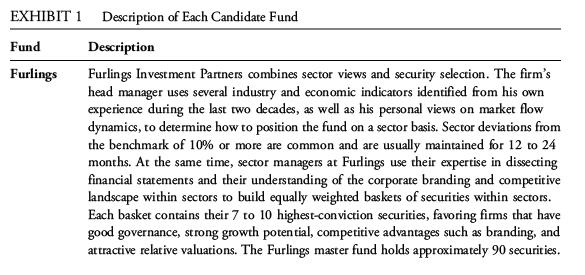

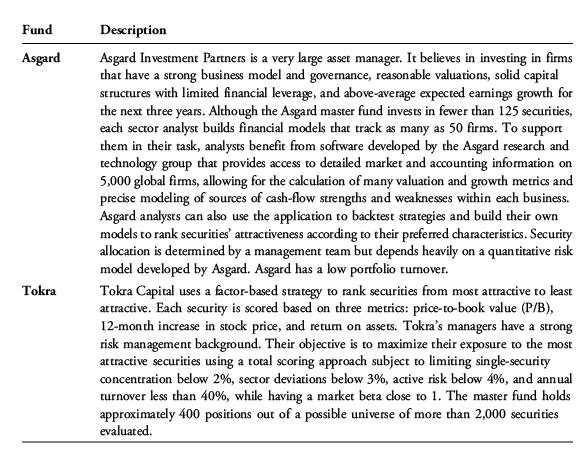

He is considering whether to pursue more in-depth due diligence processes with three largecap long-only funds proposed by his analysts. Although the funds emphasize different financial metrics and use different implementation methodologies, they operate in the same market segment and are evaluated against the same benchmark. The analysts prepared a short description of each fund, presented in Exhibit 1.

When Leonard’s analysts met with Asgard, they inquired whether its managers engage in activist investing because Asgard’s portfolio frequently holds significant positions, because of their large asset size, and because of their emphasis on strong governance and their ability to model sources of cash-flow strengths and weaknesses within each business. The manager indicated that Asgard engages with companies from a long-term shareholder’s perspective, which is consistent with the firm’s low portfolio turnover, and uses its voice, and its vote, on matters that can influence companies’ long-term value.

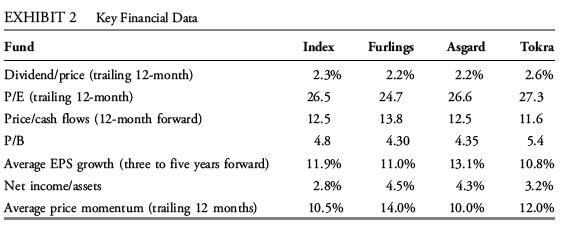

Leonard wants to confirm that each manager’s portfolios are consistent with its declared style. To this end, Exhibit 2 presents key financial information associated with each manager’s portfolio and also with the index that all three managers use.

Step by Step Answer: