You are analyzing the U.S. equity market based upon the S&P 500 Index and using the present

Question:

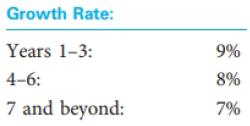

You are analyzing the U.S. equity market based upon the S&P 500 Index and using the present value of free cash flow to equity technique. Your inputs are as follows: Beginning FCFE: $80 k = 0.09

a. Assuming that the current value for the S&P 500 Index is 2,050, would you underweight, overweight, or market weight the U.S. equity market?

b. Assuming that there is a 1 percent increase in the rate of inflation, what would be the market's value, and how would you weight the U.S. market? State your assumptions.

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investment Analysis and Portfolio Management

ISBN: 978-1305262997

11th Edition

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds

Question Posted: