The universe of available securities includes two risky stock funds, A and B, and T-bills. The data

Question:

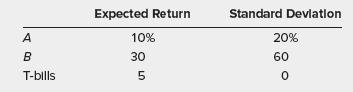

The universe of available securities includes two risky stock funds, A and B, and T-bills. The data for the universe are as follows:

The correlation coefficient between funds A and B is −.2.

a. Draw the opportunity set of funds A and B.

b. Find the optimal risky portfolio, P, and its expected return and standard deviation.

c. Find the slope of the CAL supported by T-bills and portfolio P.

d. How much will an investor with A = 5 invest in funds A and B and in T-bills?

Step by Step Answer:

Related Book For

ISE Investments

ISBN: 9781260571158

12th International Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus

Question Posted: