A zerocoupon bond has 12 years to maturity and is selling for $300. Given the 24 semiannual

Question:

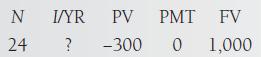

A zero‐coupon bond has 12 years to maturity and is selling for $300. Given the 24 semiannual periods, the power to be used in raising the ratio of $1,000/$300, or 3.3333, is 0.04167 (calculated as 1/(2 × 12)). Using a calculator with a power function produces a value of 1.05145. Subtracting the 1.0 and multiplying by 100 leaves a semiannual ytm, of 5.145 percent. The YTM is 10.29 percent.

Using a financial calculator,

Computing I/YR, we find the semiannual yield, ytm, to be 5.1445 percent. The YTM is 10.29 percent.

Transcribed Image Text:

N I/YR 24 ? -300 PV PMT FV 0 1,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Based on the given information we have a zerocoupon bond with 12 years to maturity selling for 300 W...View the full answer

Answered By

Mustafa olang

Please accept my enthusiastic application to solutionInn. I would love the opportunity to be a hardworking, passionate member of your tutoring program. As soon as I read the description of the program, I knew I was a well-qualified candidate for the position.

I have extensive tutoring experience in a variety of fields. I have tutored in English as well as Calculus. I have helped students learn to analyze literature, write essays, understand historical events, and graph parabolas. Your program requires that tutors be able to assist students in multiple subjects, and my experience would allow me to do just that.

You also state in your job posting that you require tutors that can work with students of all ages. As a summer camp counselor, I have experience working with preschool and kindergarten-age students. I have also tutored middle school students in reading, as well as college and high school students. Through these tutoring and counseling positions, I have learned how to best teach each age group. For example, I created songs to teach my three-year-old campers the camp rules, but I gave my college student daily quizzes to help her prepare for exams.

I am passionate about helping students improve in all academic subjects. I still remember my excitement when my calculus student received her first “A” on a quiz! I am confident that my passion and experience are the qualities you are looking for at solutionInn. Thank you so much for your time and consideration.

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen

Question Posted:

Students also viewed these Business questions

-

1. Suppose a bond that has semiannual coupons is selling for $10,500. It has 7 years left until maturity. Its par value is $10,000 and its YTM is 7%. What is this bonds annual coupon rate? 2. If the...

-

Jasmine's stock is selling for RM15 per share. Jasmine does not intend to pay any dividend. However, it will pay a dividend of RM2.00 at the end of year 3. After that, dividends are expected to grow...

-

1. Determine reasonable design values for the number of active coils, the wire and coil diameters of an infinite-life helical compression spring with a minimum load of 12 lb force and a maximum load...

-

Distinguish between a National Health Insurance system and a National Health Service. Provide examples of each. What kind of a system does the United States have?

-

For a boiler at a power station, heat must be transferred to boiling water at the rate of 3 GW. The boiling water passes through copper pipes having a wall thickness of 4.0 mm and a surface area of...

-

A particle of mass 4.00 kg is attached to a spring with a force constant of 100 N/m. It is oscillating on a horizontal frictionless surface with an amplitude of 2.00 m. A 6.00-kg object is dropped...

-

E 6-5 General questions [Based on AICPA] 1. On January 1, 2016, Pam Company sold equipment to its wholly owned subsidiary, Sun Company, for $1,800. The equipment cost Pam $2,000. Accumulated...

-

Presented below is a partially completed Statement of Activities for a homeless shelter. Complete the Statement of Activities by filling in any missing amounts. (Include zero amounts.) CENTERVILLE...

-

Dog Up! Franks is looking at a new sausage system with an installed cost of $581,302. This cost will be depreciated straight-line to 58,163 over the project's 7-year life, at the end of which the...

-

Norr and Caylor established a partnership on January 1, 2019. Norr invested cash of $100,000 and Caylor invested $30,000 in cash and equipment with a book value of $40,000 and fair value of $50,000....

-

Assume a 15year, 6 percent bond is callable in 5 years at a price of $1,050. The bond currently sells for $1,075. The semiannual yield to call is calculated as I/YR, the semiannual yield to call, is...

-

According to the expectations theory, a fiveyear bond will have the same expected return as a twoyear bond held to maturity plus a threeyear bond bought at the beginning of the third year.

-

The viral load for an HIV patient is 52.0 RNA copies/mL before treatment begins. Eight days later the viral load is half of the initial amount. (a) Find the viral load after 24 days. (b) Find the...

-

1. The interest rate charged on a loan of $85,000 is 7.75% compounded annually. If the loan is to be paid off over seven years, calculate the size of the annual payments. 2. A $10,000 debt is repaid...

-

Referring to the NISSAN Navara 5L SE M/T, which is using Nissan YD25 engine, provide your analysis to the following questions: A. What will be the maximum power produced by this vehicle at the...

-

Convert each pair of rectangular coordinates to polar coordinates where r> 0 and 0 <2.

-

Please type your answers and submit them on Blackboard by the due time. AAA corp. had the following PP&E values on Dec. 31, 2018. Cost $ 100 Accumulated Depreciation $ 20 Undiscounted Future Cash...

-

Compute the standard deviation"sigma symbol"for ages of British nurses in 1851. Assume that the table below shows the age distribution of nurses in Great Britain in 1851. Round your answer to nearest...

-

How does reading current news articles help IT security professionals in their daily jobs?

-

Nitrogen monoxide reacts with hydrogen as follows: 2NO(g)+ H2(g) N2O(g) + H2O(g) The rate law is [H2]/ t = k[NO]2[H2], where k is 1.10 107 L2/(mol2s) at 826oC. A vessel contains NO and H2 at...

-

Bankrupt and insolvent taxpayers do not recognize income if debt is discharged. They must, however, reduce specified tax attributes. What is involved?

-

Are partners and proprietors at a disadvantage with respect to fringe benefits? Explain.

-

Why are cafeteria plans helpful in the design of an employee benefit plan that provides nontaxable fringe benefits?

-

nformation pertaining to Noskey Corporation s sales revenue follows: November 2 0 2 1 ( Actual ) December 2 0 2 1 ( Budgeted ) January 2 0 2 2 ( Budgeted ) Cash sales $ 1 0 5 , 0 0 0 $ 1 1 5 , 0 0 0...

-

The management team of Netflix maintains a stable dividend using the Lintner model: Dt+1 = Dt + EPS Target Payout Where Dt (Dt+1) = dividend in the current period t (the next period t + 1) EPSt =...

-

#1 #2 hapter 50 10 D Werences lav Help Required information [The following information applies to the questions displayed below) Archer Company is a wholesaler of custom-built air-conditioning units...

Study smarter with the SolutionInn App