Question

Norr and Caylor established a partnership on January 1, 2019. Norr invested cash of $100,000 and Caylor invested $30,000 in cash and equipment with a

Norr and Caylor established a partnership on January 1, 2019. Norr invested cash of $100,000 and Caylor invested $30,000 in cash and equipment with a book value of $40,000 and fair value of $50,000. For both partners, the beginning capital balance was to equal the initial investment. Norr and Caylor agreed to the following procedure for sharing profits and losses:

- 12% interest on the yearly beginning capital balance

- $10 per hour of work that can be billed to the partnership's clients

- the remainder divided in a 3:2 ratio

The Articles of Partnership specified that each partner should withdraw no more than $1,000 per month, which is accounted as direct reduction of that partner’s capital balance.

For 2019, the partnership's income was $70,000. Norr had 1,000 billable hours, and Caylor worked 1,400 billable hours. In 2020, the partnership's income was $24,000, and Norr and Caylor worked 800 and 1,200 billable hours respectively. Each partner withdrew $1,000 per month throughout 2019 and 2020.

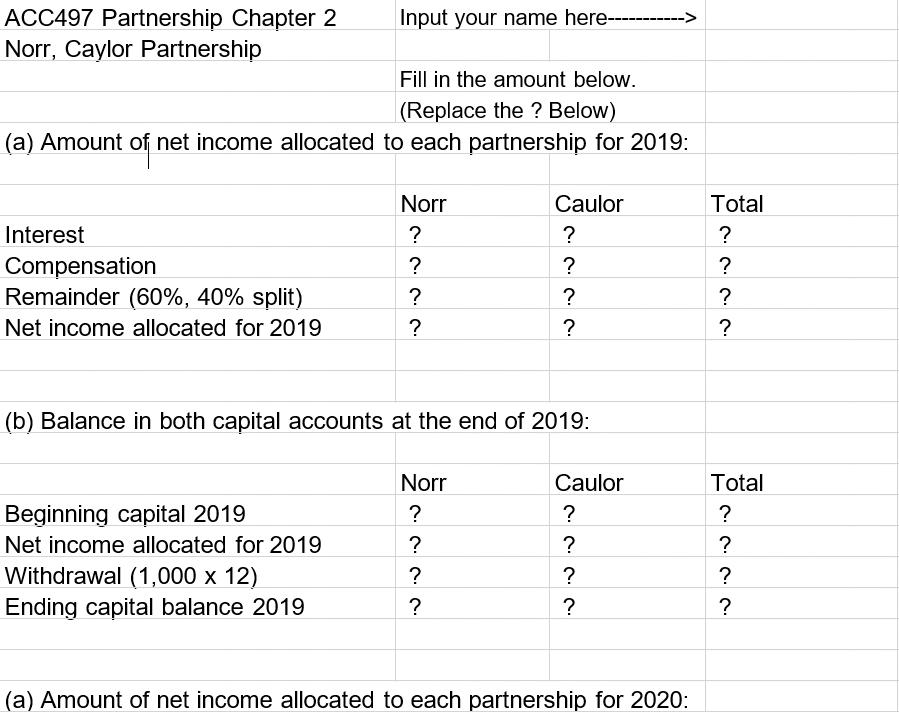

Complete the following:

- Determine the amount of net income allocated to each partner for 2019.

- Determine the balance in both capital accounts at the end of 2019.

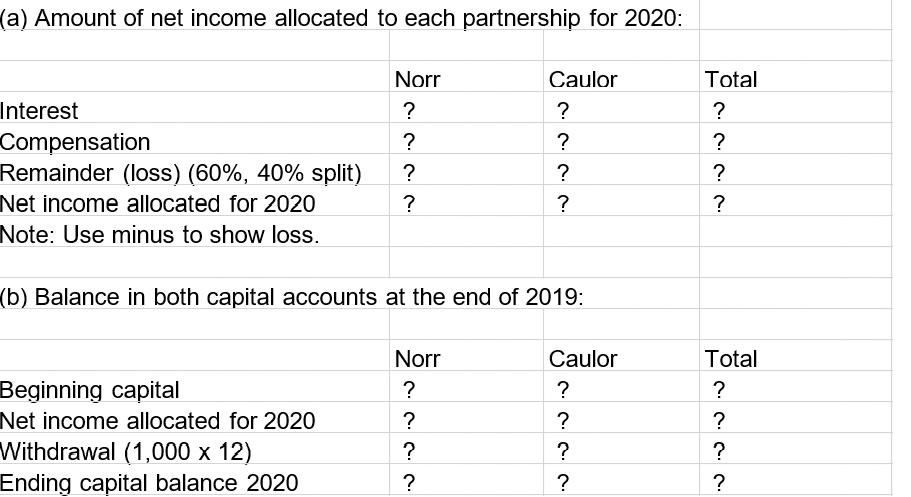

- Determine the amount of net income allocated to each partner for 2020. (Round all calculations to the nearest whole dollar).

- Determine the balance in both capital accounts at the end of 2020 to the nearest dollar.

ACC497 Partnership Chapter 2 Input your name here---- Norr, Caylor Partnership Fill in the amount below. (Replace the ? Below) (a) Amount of net income allocated to each partnership for 2019: Norr Caulor Total Interest ? ? ? Compensation ? ? ? Remainder (60%, 40% split) ? ? ? Net income allocated for 2019 ? ? ? (b) Balance in both capital accounts at the end of 2019: Norr Caulor Total Beginning capital 2019 ? ? ? Net income allocated for 2019 ? ? ? Withdrawal (1,000 x 12) ? ? ? Ending capital balance 2019 ? ? ? (a) Amount of net income allocated to each partnership for 2020:

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Amount of net mleme allocated to each partner for 2019 Norr Cautor Total Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started