Consider newly issued bond A with a threeyear maturity, a 10 percent coupon rate, and a required

Question:

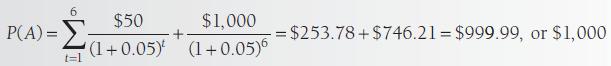

Consider newly issued bond A with a three‐year maturity, a 10 percent coupon rate, and a required semiannual yield of 5 percent. Assuming semiannual interest payments of $50 for each of the next six periods, the price of bond A, based on Equation 17‐9, is

The bond’s price should be $1,000 since its coupon rate equals its required yield.

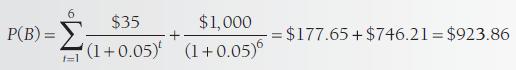

Now consider bond B, with risk identical to bond A, issued five years ago when its required yield was 7 percent. Assume that the bond’s required yield now is 10 percent, or 5 percent on a semiannual basis, and that the bond has three years left to maturity. Investors certainly will not pay $1,000 for bond B and receive $70 coupons per year, or $35 semiannually, when they can pay $1,000 for bond A and receive $100 per year. However, they will pay a price determined by the use of Equation 17‐9.

Equation 17‐9

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen