Assume an investor had $1,000 to invest three years ago. This investor purchased a 10 percent coupon

Question:

Assume an investor had $1,000 to invest three years ago. This investor purchased a 10 percent coupon bond with a three‐year maturity at face value. The promised YTM for this bond was 10 percent.

Assume the investor reinvested each coupon at a semiannual rate, or ytm, of exactly 5 percent. At the end of the three years, the investor has a total ending wealth of $1,340.10 which includes the initial investment of $1,000 (in other words, the investor earned $340.10 on the $1,000, given the compounding over time).

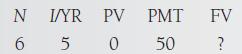

This $340.10 is a combination of the coupons and the interest earned on the coupons. Using the calculator,

Solving for FV produces $340.10 which added to the maturity value of the bond gives us a total dollar return of $1,340.10.

The realized compound yield on this investment, under the circumstances described, is 5 percent on a semiannual basis or 10 percent on a bond equivalent basis, calculated as [$1,340.10 / $1,000]1/6 - 1.0 = 5% semiannually, or 10% on a bond equivalent basis.

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen