Consider a 10 percent coupon bond with three years to maturity. The annual coupon is $100, which

Question:

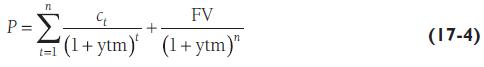

Consider a 10 percent coupon bond with three years to maturity. The annual coupon is $100, which is paid $50 every six months, and the total number of semiannual periods is six. Assume that the bond is selling at a premium with a current market price of $1,052.10. Because of the inverse relation between bond prices and market yields, it is clear that yields have declined since the bond was originally issued, because the price is greater than $1,000. Using Equation 17‐4, we can illustrate conceptually what is happening when we solve for ytm, although to actually solve for ytm we would use a calculator or computer.

Equation 17‐4

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen

Question Posted: