Consider the amount of retirement wealth that can be accumulated by one individual contributing $5,000 annually to

Question:

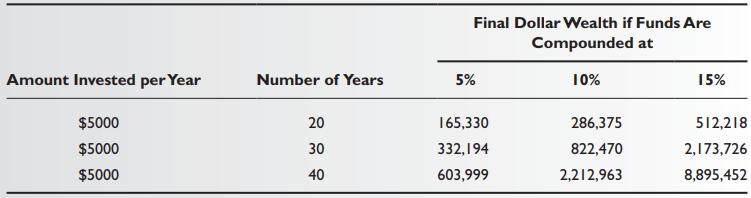

Consider the amount of retirement wealth that can be accumulated by one individual contributing $5,000 annually to a tax‐sheltered account if returns are compounded annually. Over many years of investing, the differences in results that investors realize, owing solely to the investment returns earned, can be staggering. Note that in the case of a $5,000 annual contribution for 40 years, the payoff at a compound earnings rate of 15 percent is almost $9 million. In contrast, at an earnings rate of 10 percent the payoff is $2.21 million, which is a great outcome but significantly less than almost $9 million. Similarly, if a 10 percent rate of return can be obtained instead of a 5 percent rate of return, over a period of 40 years the difference approaches a fourfold multiple. Clearly, good investment decisions, which lead to higher returns can make a tremendous difference in the wealth that you accumulate. None other than Albert Einstein is rumored to have said “compound interest is the most powerful force in the universe.

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen