In Example 1917, N(d 1 ) was 0.4785; therefore, to hedge a 1,000 share portfolio, the investor

Question:

In Example 19‐17, N(d1) was 0.4785; therefore, to hedge a 1,000 share portfolio, the investor should write 21 call options [(1/0.4785) 1,000 2,089.86 individual options or about 21 contracts]. A $1 increase in the price of the stock should produce approximately a $0.4785 change in the price of the option. The loss on the call options written is 2,100 × $0.4785 = $1,004.85, which is approximately offset by the $1 per‐share gain on the 1,000 shares. A perfectly hedged position leaves total wealth unchanged.

Example 19‐17

The following is an example of the use of the Black–Scholes option pricing formula: Assume

S = $40

E = $45

r = 0.10

t = 0.5 (6 months)

σ = 0.45

Step 1: Solve for d1.

![d In(40/45) + [0.10+0.5(0.45)10.5 0.45 [(0.5) /2] -0.1178 +0.1006 0.3182 = -0.054](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1703/5/8/4/875658aa46b2a2b61703584874445.jpg)

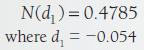

Step 2: Use a cumulative probability distribution table to find the value of N (d1).

Step 3: Find d2.

![d = -0.054-[0.45((0.5)/2)] = -0.372](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1703/5/8/4/936658aa4a817c8b1703584935337.jpg)

Step 4: Find N (d2).

![]()

Step 5: Solve for C.

![C=S[0.4785]-E[1/(0-1)(0.5)] [0.3549] 19.14-45(0.9512) (0.3549) = = 19.14-15.19 = $3.95](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1703/5/8/5/084658aa53c2d5801703585083442.jpg)

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen