Question: Required - Please submit the following two documents: 1. Using Excel, submit the following: i. ii. Calculate Rashmika's minimum net income for tax purposes

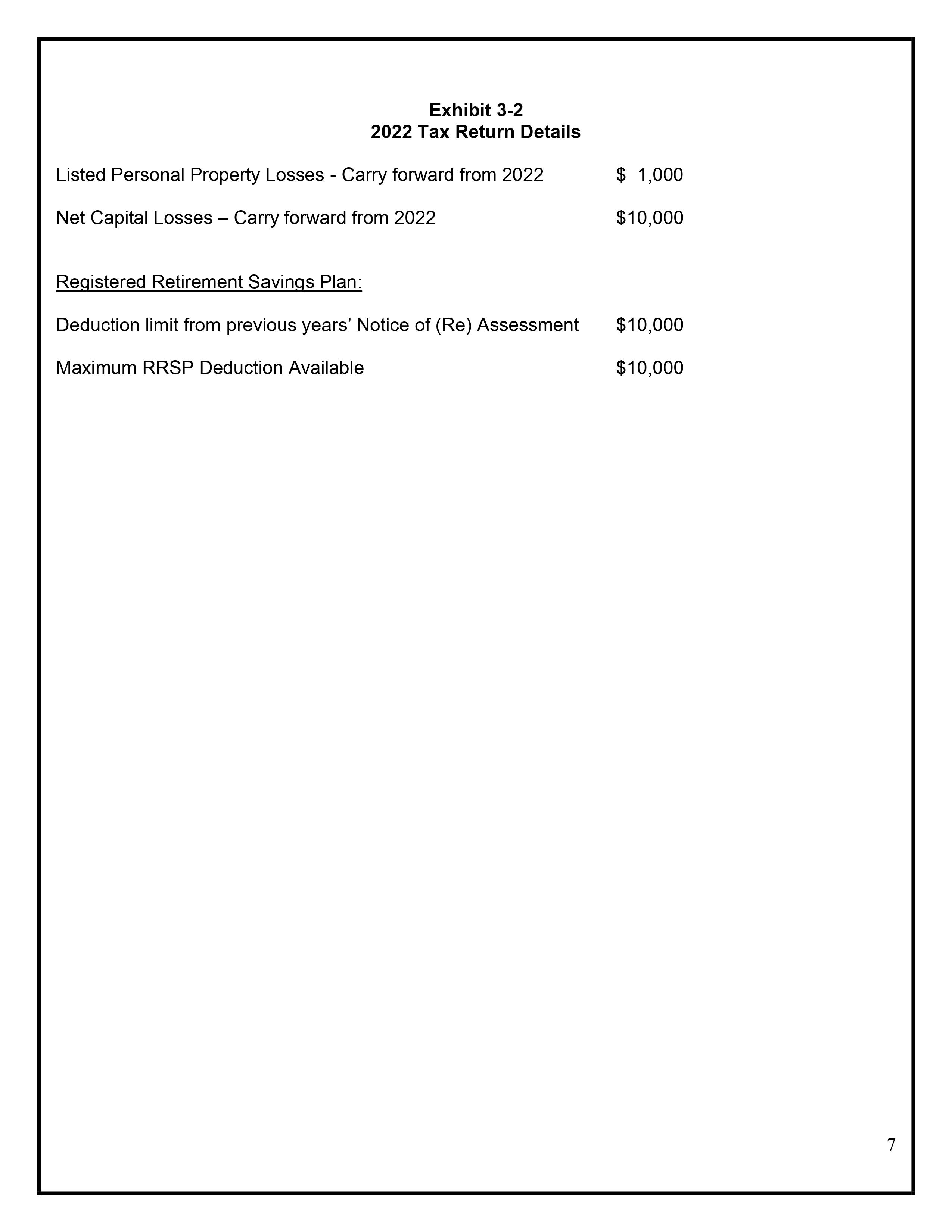

Required - Please submit the following two documents: 1. Using Excel, submit the following: i. ii. Calculate Rashmika's minimum net income for tax purposes in accordance with the ordering provisions found in section 3 of the Income Tax Act, and her minimum taxable income for the 2023 taxation year. Based on your answer to part (a), calculate Rashmika's minimum federal income tax for the 2023 taxation year. Show all calculations. 2. In a Word document, a one-page client summary section (memo) presenting the main issues related to the tax results, including the identification of and discussion about, the determination of the various sources of income. You will need to determine what is important for future tax planning purposes and/or for your client to know and understand. This is where you are expected to demonstrate your understanding of the more important personal tax provisions that you feel may impact your client the most. 3 Client Information In 2023, Rashmika Manda is employed by Glorious Gardens Illustrated Ltd (GGI), a Canadian controlled private corporation. She was recently promoted from Associate Editor to Editor in Chief, a promotion she worked very hard for over the past three years. Rashmika has requested your assistance in preparing her 2023 income tax return and your advice on certain other tax matters. Information regarding Rashmika's financial activities for 2023 is outlined in Exhibit 3-1. Selected information from her 2022 tax return is provided in Exhibit 3-2. Exhibit 3-1 Rashmika Manda 2023 Financial Information 1. In 2023, Rashmika received a salary of $150,000. From her income, GGI deducted income tax of $33,000, $3,754 of CPP, and $1,002 of EI. GGI contributed $700 as Rashmika's premium on a supplementary unemployment insurance plan and paid $1,000 to the Professional Writer's Association of Canada for Ramshika's professional dues that relate to maintaining her professional status, which is a condition of her employment. The company also contributed $5,000 to its registered pension plan on Rashmika's behalf, and Rashmika made a matching contribution of $5,000. GGI also provides Ramshika with $500,000 in life insurance coverage, as well as a supplemental accident and sickness insurance plan. The 2023 cost to GGI for the life insurance coverage was $675, while the cost for the accident and sickness plan was $472. The accident and sickness plan would pay cash benefits due to injury or illness, but it would not pay periodic benefits to replace salary if Ramshika were unable to work. Ramshika does not contribute to the payments for the accident and sickness plan. 2. Much of Ramshika's employment involves remote work and is required by her employer to maintain an office in her home. This home office occupies 18% of the space in her residence and is viewed as her principal place of business/employment. The 2023 expenses associated with this residence are as follows: Electricity Municipal property tax Mortgage interest Insurance Repairs to roof Lawn maintenance Snow removal Total $ 4,680 19,200 12,000 3,450 4,970 863 647 $45,810 3. Ramshika does an extensive amount of travel with location crews for story and feature photo shoots to gain more insight about the stories and locations for each publication. All the travel is incurred while she is away from her employer's head office for at least 24 consecutive hours. According to her employment contract, she is required to pay her own travel expenses. She receives a flat rate monthly allowance of $1,000 to cover her travel expenses. The actual travel expenses for 2023 were as follows: 4 Hotels $4,200 Meals while travelling 1,650 Airline tickets 2,150 In addition to these expenses, Ramshika used her own automobile, which she purchased many years ago for some of the travel. In 2023, she drove 32,000 kilometres, with 16,000 of these related to her travel for GGI and the remaining 16,000 for personal use. Operating expenses for the year totalled $3,200. GGI has advised her that CCA on the automobile for the year (100% basis) would be $4,500. Ramshika received no allowance for the use of her automobile. 4. Throughout their marriage, the Manda's have always lived in their condominium, but they decide to purchase a four-bedroom bungalow in the same neighbourhood for $672,000 on July 1, 2023. On this date, GGI provides Ramshika with a $250,000 interest-free loan that will facilitate the purchase. However, the balance must be paid in full on July 1, 2028. Assume that the prescribed interest rate is 1% throughout 2023. Rashmika and her husband decided to keep the condominium and rent it in 2023. Their hope is to have their daughter live there while she attends university in a few years. They purchased the property in 2005 at a cost of $120,000. In 2023, they received $15,000 as rent and paid the following expenses: - Property management fee $3,000 property tax $2,000 strata fees $5,000 - repairs and maintenance. $3,000 5. GGI granted Ramshika an option to purchase 1,200 shares of its stock at a price of $37/share in February 2021. At the time the options were granted, the FMV of the shares was $40 each. In July 2022, when the shares were trading at $45/share, Ramshika exercised all the options. In 2023, Ramshika transferred ownership of the shares to her 16-year-old daughter, Roma, so she could save any future dividend income for her future university tuition or sell them for a profit. The FMV of the shares at this time grew to $50/share. Roma received a $2,000 non- eligible dividend in 2023 and she continues to own the shares as of December 31, 2023. 6. In 2023, Rashmika had the following other receipts and disbursements: In recognition of 10 years of continuous service, she receives a smart watch with a retail value of $1,200. This is the first time she has received an anniversary gift. At Christmas all GGI employees receive a gift basket containing gourmet food items. The retail value of this basket is $300. Legal fee to defend last year's income tax reassessment $1,000. 7. While packing to move from the condo to the bungalow, Rashmika found some forgotten antique jewelry. She purchased it for $900 in 2006 and in October 2023, sold it online for $2,500. She also sold an antique vase for $2,200, which was purchased for $800 in 2005. 5 8. Rashmika is married and lives with her husband, 16-year-old daughter, and infirm sister (age 65). Her husband had employment income of $120,000 in 2023; her daughter works a part- time job and earned $7,500 in 2023; her sister had a net income for tax purposes of $15,000. Rashmika estimates that she spent $4,700 toward her sister's support. In 2023, Rashmika paid $2,500 for eligible medical expenses, including $500 for prescription contact lenses. 9. Rashmika is an active member in her community and volunteers as a reading tutor at Central City Literacy Resources (CCLR), a registered Canadian charitable organization. She in turn donated $5,000 in 2023 to fund, in part, a new literacy outreach program for local public schools. 10. In 2023, Rashmika made an RRSP contribution of $11,000. 11. Rashmika received a dividend of $1,000 from the active business income of a Canadian public company and an $1,800 (net of $200 withholding tax) dividend from a U.S. company. She paid $200 to an investment advisor for advice regarding her RRSP investment. 12. Rashmika began consulting with her condominium Strata to collaborate on ways to promote reducing waste and upcycling materials from residents. Given her editorial and literary expertise, the strata voted for Rashmika to review a report and supporting promotional materials that outlined the options available to the condominium residents. Rashmika did not want payment for doing this but the residents voted to give her three months of strata fees in exchange for her services. 10 6 Exhibit 3-2 2022 Tax Return Details Listed Personal Property Losses - Carry forward from 2022 Net Capital Losses - Carry forward from 2022 $ 1,000 $10,000 Registered Retirement Savings Plan: Deduction limit from previous years' Notice of (Re) Assessment $10,000 Maximum RRSP Deduction Available $10,000 7

Step by Step Solution

There are 3 Steps involved in it

It appears that youve provided a comprehensive set of financial information for an individual named Rashmika Manda which includes details on income ex... View full answer

Get step-by-step solutions from verified subject matter experts