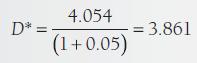

Using the duration of 4.054 years from Example 1812 and the YTM of 10 percent, the modified

Question:

Using the duration of 4.054 years from Example 18‐12 and the YTM of 10 percent, the modified duration is

Example 18‐12

Consider a 10 percent coupon bond with a YTM of 10 percent and a five‐year life. This bond has a duration of 4.054 years, approximately 1 year less than maturity. However, if the maturity of this bond was 10 years, it would have an effective life (duration) of 6.76 years, and with a 20‐year maturity, it would have an effective life of only 9.36 years. Furthermore, a 50‐year maturity for this bond would change the effective life to only 10.91 years. The reason for the sharp differences between the term to maturity and the duration is that cash receipts received in the distant future have very small present values and, therefore, add little to a bond’s value.

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen