A Kalmo Ltd offers a subcontracting service in assembly, painting and packing. Components are supplied by customers

Question:

A Kalmo Ltd offers a subcontracting service in assembly, painting and packing. Components are supplied by customers to the company, the required operations are then carried out, and the completed work returned to the customer. The company is labour intensive, with only a relatively small amount of materials purchased.

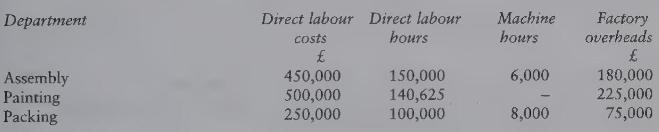

Currently, one factory overhead recovery rate is used which is a percentage of total direct labour costs. This is calculated from the following budgeted costs.

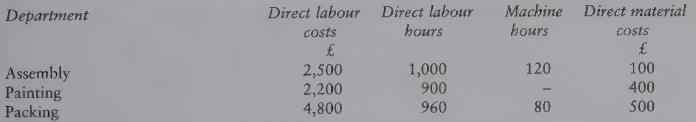

The cost sheet for Job 131190 shows the following information:

General administration expenses of 20 per cent are added to the total factory costs, and then a further 25 per cent of the total cost is added as profit, to arrive at the selling price.

Although the company has been using the blanket factory overhead recovery rate for a number of years, one of the directors has questioned this method, and asks if it would be possible to apply overhead recovery rates for each department.

Required A Calculate the current factory overhead recovery rate, and apply this to arrive at the selling price for Job 131190.

B In line with the director's comments, calculate overhead recovery rates for each department, using two alternative methods, and apply both to arrive at new selling prices for Job 131190.

C Briefly evaluate the methods you have used for, the recovery of factory overheads, justifying which one you consider to be most appropriate.

D Outline how an unsatisfactory method of overhead absorption can affect the profits of a business.

Step by Step Answer: