A (Note: this question covers material from both Chapters 43 and 44.) HGW Limited produces a product

Question:

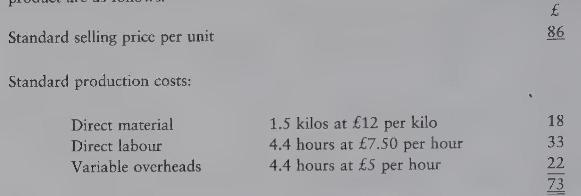

A (Note: this question covers material from both Chapters 43 and 44.) HGW Limited produces a product called a Lexton. The standard selling price and the manufacturing costs of this product are as follows:

The projected production and sales for March 19X4 were 520 units.

On 1 April 19X4 the following actual figures were determined.

Sales Production Direct material \(\quad 785\) kilos at \(£12.40

\) per kilo Direct labour \(\quad 2,400\) hours at \(£ 7.80\) per hour Overheads \(\quad £ 12,500\) (overall variance \(£ 400\) adverse)

There was no opening stock of the product Lexton.

\section*{Required:}

(a) Prepare an actual profit and loss statement for HGW Ltd for March 19X4

(b) Calculate the following variances and their respective sub-variances:

(i) sales - price and volume

(ii) direct material - price and usage

(iii) direct labour - rate and efficiency

(c) Prepare a statement reconciling the actual profit calculated in part

(a) with the budgeted profit on actual sales. (Use the variances calculated in part

(b) and the given overhead variance.)

(d) Write a report to the management outlining the factors that need to be considered when standards are being established.

Step by Step Answer: