Burden plc has an authorised capital of 500,000 ordinary shares of 0.50 each. (a) At the end

Question:

Burden plc has an authorised capital of 500,000 ordinary shares of £0.50 each.

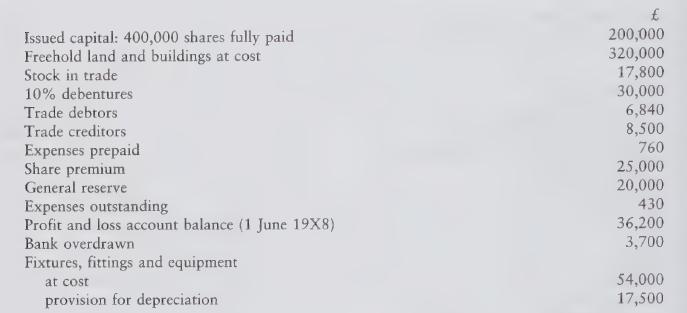

(a) At the end of its financial year, 31 May 19X9, the following balances appeared in the company’s books:

The company’s trading and profit and loss accounts had been prepared and revealed a net profit of £58,070. However, this figure and certain balances shown above needed adjustment in view of the following details which had not been recorded in the company’s books.

(i) It appeared that a trade debtor who owed £300 would not be able to pay. It was decided to write his account off as a bad debt.

(ii) An examination of the company’s stock on 31 May 19X9 revealed that some items shown in the accounts at a cost of £1,800 had deteriorated and had a resale value of only £1,100.

(iii) At the end of the financial year some equipment which had cost £3,600 and which had a net book value of £800 had been sold for £1,300. A cheque for this amount had been received on 31 May 19X9.

Required:

1. A statement which shows the changes which should be made to the net profit of £58,070 in view of these unrecorded details.

(b) The directors proposed to pay a final dividend of 10% and to transfer £50,000 to general reserve on 31 May 19X9.

Required:

For Burden ple (taking account of all the available information)

2 The profit and loss appropriation account for the year ended 31 May 19X9.

3. Two extracts from the company’s balance sheet as at 31 May 19X9, showing in detail:

(i) the current assets, current liabilities and working capital (ii) the items which make up the shareholders’ funds.

(c) The directors are concerned about the company’s liquidity position.

Required:

4 THREE transactions which will increase the company’s working capital. State which balance sheet items will change as a result of each transaction and whether the item will increase or decrease in value.

Step by Step Answer: