D Smith is to open a retail shop on 1 January (19 mathrm{X} 4). He will put

Question:

D Smith is to open a retail shop on 1 January \(19 \mathrm{X} 4\). He will put in \(£ 25,000\) cash as capital. His plans are as follows:

(i) On 1 January \(19 \mathrm{X} 4\) to buy and pay for Premises \(£ 20,000\), Shop fixtures \(£ 3,000\), Motor van \(£ 1,000\).

(ii) To employ two assistants, each to get a salary of \(£ 130\) per month, to be paid at the end of each month. (PAYE tax, National Insurance contributions, etc., are to be ignored.)

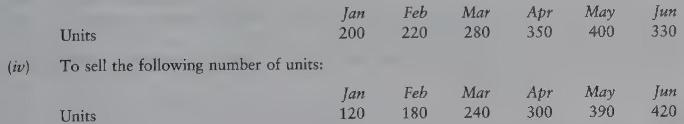

(iii) To buy the following goods (shown in units):

(v) Units will be sold for \(£ 10\) each. One-third of the sales are for cash, the other two-thirds being on credit. These latter customers are expected to pay their accounts in the second month following that in which they received the goods.

(vi) The units will cost \(£ 6\) each for January to April inclusive, and \(£ 7\) each thereafter. Creditors will be paid in the month following purchase. (Value stock-in-trade on FIFO basis.)

(vii) The other expenses of the shop will be \(£ 150\) per month payable in the month following that in which they were incurred.

(viii) Part of the premises will be sub-let as an office at a rent of \(£ 600\) per annum. This is paid in equal instalments in March, June, September and December.

(ix) Smith's cash drawings will amount to \(£ 250\) per month.

(x) Depreciation is to be provided on Shop fixtures at 10 per cent per annum and on the Motor van at 20 per cent per annum.

You are required to:

(a) Draw up a cash budget for the six months ended 30 June \(19 \mathrm{X} 4\), showing the balance of cash at the end of each month.

(b) Draw up a forecast trading and profit and loss account for the six months ended 30 June 19X4 and a balance sheet as at that date.

Step by Step Answer: