On 1 April 19X1 Machinery Limited bought 80 per cent of the ordinary share capital of Components

Question:

On 1 April 19X1 Machinery Limited bought 80 per cent of the ordinary share capital of Components Limited and on 1 April 19X3 Machinery Limited was itself taken over by Sales Limited who purchased 75 per cent of the ordinary shares in Machinery Limited.

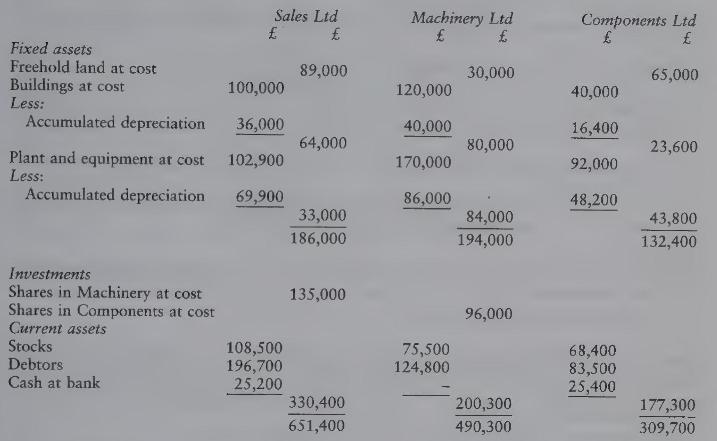

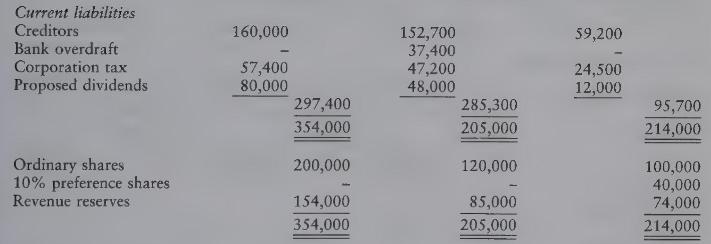

The balance sheets of the three companies at 31 October 19X5 prepared for internal use showed the following position:

Additional information

(a) All ordinary shares are \(£ 1\) each, fully paid.

(b) Preference shares in Components Ltd are 50p each fully paid.

(c) Proposed dividends in Components Ltd are:

on ordinary shares \(£ 10,000\);

on preference shares \(£ 2,000\).

(d) Proposed dividends receivable by Sales Ltd and Machinery Ltd are included in debtors.

(e) All creditors are payable within one year.

(f) Items purchased by Machinery Ltd from Components Ltd and remaining in stock at 31 October 19X5 amounted to \(£ 25,000\). The profit element is 20 per cent of selling price for Components Ltd.

\((g)\) Depreciation policy of the group is to provide for:

(i) buildings - at the rate of 2 per cent on cost each year;(ii) plant and equipment - at the rate of 10 per cent on cost each year including full provision in the year of acquisition.

These policies are applied by all members of the group.

Included in the plant and equipment of Components Ltd is a machine purchased from the manufacturers, Machinery Ltd, on 1 January 19 X 4 for \(£ 10,000\). Machinery Ltd recorded a profit of \(£ 2,000\) on the sale of the machine.

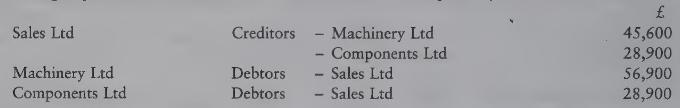

(b) Intra-group balances are included in debtors and creditors respectively and are as follows:

(i) A cheque drawn by Sales Ltd for \(£ 11,300\) on 28 October 19 X 5 was received by Machinery Ltd on 3 November 19 XS.

(j) At 1 April 19X1, reserves in Machinery Ltd were \(£ 28,000\) and in Components Ltd \(£ 20,000\). At 1 April 19 X3 the figures were \(£ 40,000\) and \(£ 60,000\) respectively.

\section*{Required:}

Prepare a group balance sheet at 31 October 19X5 for Sales Ltd and its subsidiaries complying, so far as the information will allow, with the accounting requirements of the Companies Acts.

Step by Step Answer: