A Bryon Ltd has held (1,500,000) shares in Carlyle Ltd for many years. At the date of

Question:

A Bryon Ltd has held \(1,500,000\) shares in Carlyle Ltd for many years. At the date of acquisition, the reserves of Carlyle Ltd amounted to \(£ 800,000\). On 31 March 19X6 Carlyle Ltd bought 400,000 shares in Doyle Ltd for \(£ 600,000\) and a further 400,000 shares were purchased on 30 June 19 X6 for \(£ 650,000\).

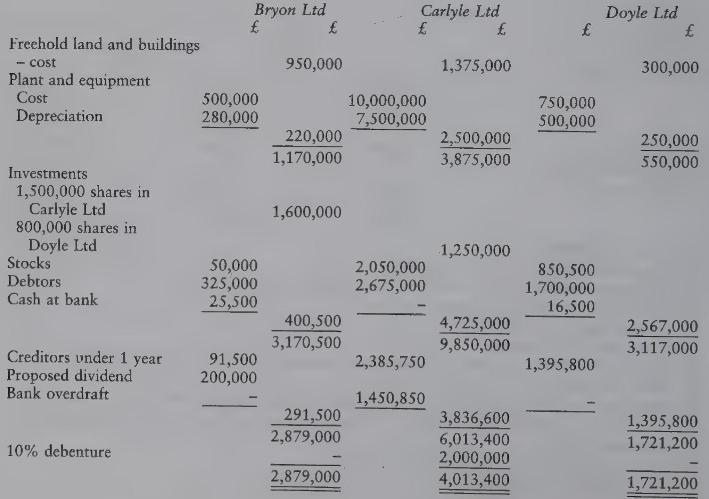

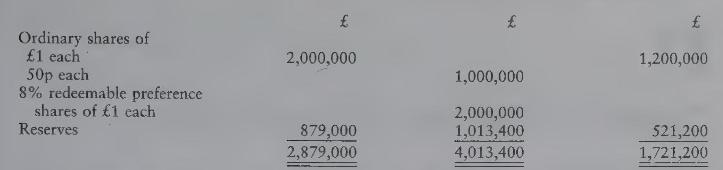

At 30 September \(19 \times 6\) the balance sheets of the three companies were:

Proposed dividends have not yet been provided for on the shares in Carlyle Ltd and Doyle Ltd although Bryon Ltd has included dividends of 5 p per share as receivable from Carlyle Ltd in debtors. Dividends on the preference shares were paid for one-half year on 1 April 19X6; the next payment date was 1 October 19X6. Dividends on the ordinary shares in Doyle Ltd are proposed at the rate of \(10 \mathrm{p}\) per share and on Carlyle's shares as anticipated by Bryon.

Profits for the year in Doyle Ltd were \(£ 310,000\), before making any adjustments for consolidation, accruing evenly through the year.

The directors of Bryon Ltd consider that the assets and liabilities of Carlyle Ltd are shown at fair values, but fair values for Doyle Ltd for the purposes of consolidation are:

Other assets and liabilities are considered to be at fair values in the balance sheet.

Additional depreciation due to the revaluation of the plant and equipment in Doyle Ltd amounts to \(£ 40,000\) for the year to 30 September \(19 \times 6\).

Included in stocks in Carlyle Ltd are items purchased from Doyle Ltd during the last three months of the year, on which Doyle Ltd recorded a profit of \(£ 80,000\).

On 30 September 19X6 Carlyle Ltd drew a cheque for \(£ 100,000\) and sent it to Doyle Ltd to clear the current account. As this cheque was not received by Doyle Ltd until 3 October, no account was taken of it in the Doyle Ltd balance sheet.

\section*{Required:}

Prepare a balance sheet as at 30 September 19X6 for Bryon Ltd and its subsidiaries, conforming with the Companies Acts so far as the information given will permit.

Ignore taxation.

Step by Step Answer: