The following information has been extracted from the books of account of Billinge plc as at 30

Question:

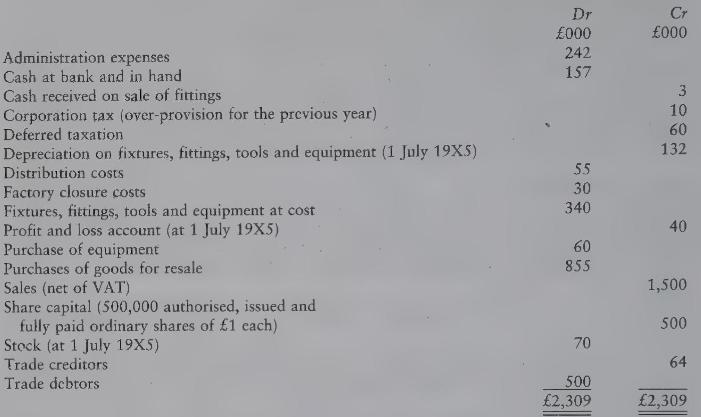

The following information has been extracted from the books of account of Billinge plc as at 30 June 19X6:

Additional information 1 The company was incorporated in 19X0.

2 The stock at 30 June 19 X6 (valued at the lower of cost or net realisable value) was estimated to be worth \(£ 100,000\).

3 Fixtures, fittings, tools and equipment all related to administrative expenses. Depreciation is charged on them at a rate of 20 per cent per annum on cost. A full year's depreciation is charged in the year of acquisition, but no depreciation is charged in the year of disposal.

4 During the year to 30 June \(19 \mathrm{X} 6\), the company purchased \(£ 60,000\) of equipment. It also sold some fittings (which had originally cost \(£ 20,000\) ) for \(£ 3,000\) and for which depreciation of \(£ 15,000\) had been set aside.

5 The corporation tax based on the profits for the year at a rate of 35 per cent is estimated to be \(£ 100,000\). A transfer of \(£ 40,000\) is to be made to the deferred taxation account.

6 The company proposes to pay a dividend of \(20 \mathrm{p}\) per ordinary share.

7 The standard rate of income tax is 30 per cent.

Required Insofar as the information permits, prepare Billinge ple's profit and loss account for the year to 30 June 19X6, and a balance sheet as at that date in accordance with the Companies Acts and appropriate accounting standards.

Step by Step Answer: