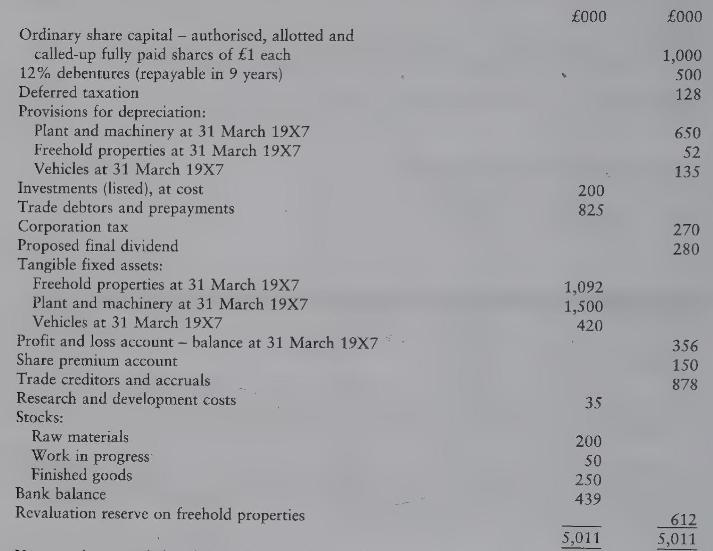

The following trial balance of X Limited, a non-listed company, has been extracted from the books after

Question:

The following trial balance of X Limited, a non-listed company, has been extracted from the books after the preparation of the profit and loss and appropriation accounts for the year ended 31 March \(19 \times 7\).

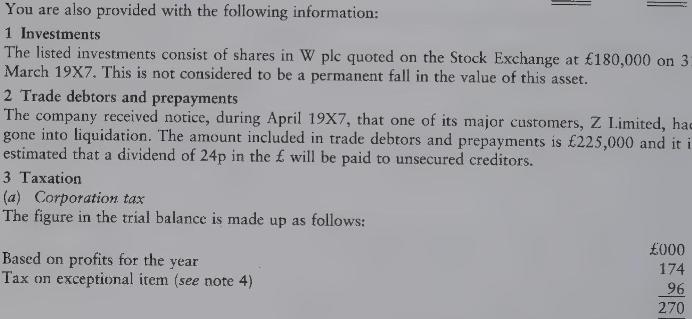

(b) Deferred taxation A transfer of \(£ 50,000\) was made from the profit and loss account during the year ended 31 March 19X7.

4 Tangible fixed assets

(a) In arriving at the profit for the year, depreciation of \(£ 242,000\) was charged, made up of freehold properties \(£ 12,000\), plant and machinery \(£ 150,000\) and vehicles \(£ 80,000\).

(b) During the year to 31 March \(19 \times 7\), new vehicles were purchased at a cost of \(£ 200,000\).

(c) During March 19X7, the directors sold one of the freehold properties which had originally cost \(£ 320,000\) and which had a written-down value at the date of the sale of \(£ 280,000\). A profit of \(£ 320,000\) on the sale, which was regarded as exceptional, has already been dealt with in arriving at the profit for the year. The estimated corporation tax liability in respect of the capital gain will be \(£ 96,000\), as shown in note 3 . After this sale, the directors decided to have the remaining freehold properties revalued, for the first time, by Messrs V \& Co, Chartered Surveyors and to include the revalued figure of \(£ 1,040,000\) in the \(19 \times 7\) accounts.

5 Research and development costs The company carries out research and development and accounts for it in accordance with the relevant accounting standard. The amount shown in the trial balance relates to development expenditure on a new product scheduled to be launched in April 19X7. Management is confident that this new product will earn substantial profits for the company in the coming years.

6 Stocks The replacement cost of the finished goods, if valued at 31 March \(19 \times 7\), would amount to \(£ 342,000\).

You are required to prepare a balance sheet at 31 March \(19 \times 7\) to conform to the requirements of the Companies Acts and relevant accounting standards insofar as the information given allows. The vertical format must be used.

The notes necessary to accompany this statement should also be prepared.

Workings should be shown, but comparative figures are not required.

Step by Step Answer: