Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part (a) Christine, Sharni and Mandy are the directors of Layabout Ltd, a company that manufactures camping equipment. Sales are falling and the directors

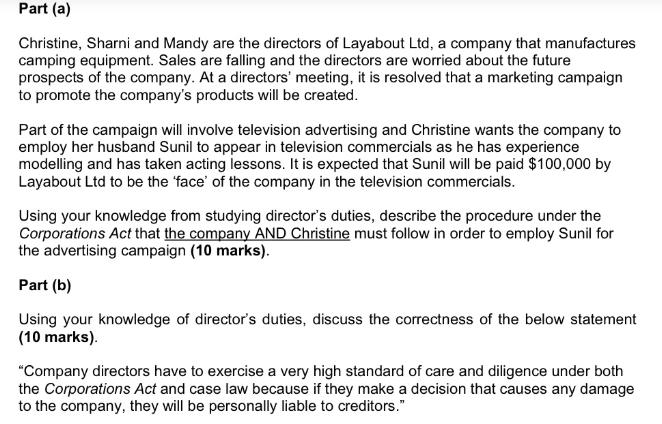

Part (a) Christine, Sharni and Mandy are the directors of Layabout Ltd, a company that manufactures camping equipment. Sales are falling and the directors are worried about the future prospects of the company. At a directors' meeting, it is resolved that a marketing campaign to promote the company's products will be created. Part of the campaign will involve television advertising and Christine wants the company to employ her husband Sunil to appear in television commercials as he has experience modelling and has taken acting lessons. It is expected that Sunil will be paid $100,000 by Layabout Ltd to be the 'face' of the company in the television commercials. Using your knowledge from studying director's duties, describe the procedure under the Corporations Act that the company AND Christine must follow in order to employ Sunil for the advertising campaign (10 marks). Part (b) Using your knowledge of director's duties, discuss the correctness of the below statement (10 marks). "Company directors have to exercise a very high standard of care and diligence under both the Corporations Act and case law because if they make a decision that causes any damage to the company, they will be personally liable to creditors."

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Part aUnder the Corporations Act the procedure that Layabout Ltd and Christine must follow to employ Sunil for the advertising campaign involves several steps Disclosure of Interest Christine as a dir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started