This appeal involves an issue of first impression in Mississippithe interpretation of [UCC] 4406 (Rev. 2002), which

Question:

This appeal involves an issue of first impression in Mississippi—the interpretation of [UCC] 4–406 (Rev. 2002), which imposes duties on banks and their customers insofar as forgeries are concerned. The case arises from a series of forgeries made by one person on four checking accounts maintained by Helen Rogers at the Union Planters Bank. * * *

Facts

Neal D. and Helen K. Rogers maintained four checking accounts with the Union Planters Bank in Greenville, Washington County, Mississippi. * * * The Rogers were both in their eighties when the events which gave rise to this lawsuit took place. After Neal became bedridden, Helen hired Jackie Reese to help her take care of Neal and to do chores and errands.

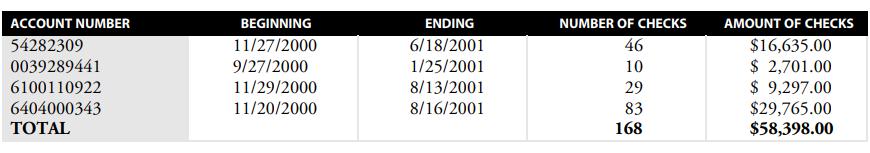

In September of 2000, Reese began writing checks on the Rogerses’ four accounts and forged Helen’s name on the signature line. Some of the checks were made out to ‘‘cash,’’ some to ‘‘Helen K. Rogers,’’ and some to ‘‘Jackie Reese.’’ The following chart summarizes the forgeries to each account:

Neal died in late May of 2001. Shortly thereafter, the Rogerses’ son, Neal, Jr., began helping Helen with financial matters. Together they discovered that many bank statements were missing and that there was not as much money in the accounts as they had thought. In June of 2001, they contacted Union Planters and asked for copies of the missing bank statements. In September of 2001, Helen was advised by Union Planters to contact the police due to forgeries made on her accounts. * * *

Subsequently, criminal charges were brought against Reese. In the meantime, Helen filed suit against Union Planters, alleging conversion (unlawful payment of forged checks) and negligence. After a trial, the jury awarded Helen $29,595 in damages, and the circuit court entered judgment accordingly. From this judgment, Union Planters appeals.

Discussion

***

The relationship between Rogers and Union Planters is governed by Article 4 of the Uniform Commercial Code, [citation]. [UCC] Section 4–406(a) & (c) provide that a bank customer has a duty to discover and report ‘‘unauthorized signatures’’; i.e., forgeries. Section 4–406 of the UCC reflects an underlying policy decision that furthers the UCC’s ‘‘objective of promoting certainty and predictability in commercial transactions.’’ The UCC facilitates financial transactions, benefitting both consumers and financial institutions, by allocating responsibility among the parties according to whomever is best able to prevent a loss. Because the customer is more familiar with his own signature, and should know whether or not he authorized a particular withdrawal or check, he can prevent further unauthorized activity better than a financial institution which may process thousands of transactions in a single day. Section 4–406 acknowledges that the customer is best situated to detect unauthorized transactions on his own account by placing the burden on the customer to exercise reasonable care to discover and report such transactions. The customer’s duty to exercise this care is triggered when the bank satisfies its burden to provide sufficient information to the customer. As a result, if the bank provides sufficient information, the customer bears the loss when he fails to detect and notify the bank about unauthorized transactions. [Citation.]

A. Union Planters’ Duty to Provide Information under §4–406(a).

The court admitted into evidence copies of all Union Planters statements sent to Rogers during the relevant time period. Enclosed with the bank statements were either the cancelled checks themselves or copies of the checks relating to the period of time of each statement. The evidence shows that all bank statements and cancelled checks were sent, via United States Mail, postage prepaid, to all customers at their ‘‘designated address’’ each month. Rogers introduced no evidence to the contrary. We therefore find that the bank fulfilled its duty of making the statements available to Rogers and that the remaining provisions of §4–406 are applicable to the case at bar. ***

In defense of her failure to inspect the bank statements, Rogers claims that she never received the bank statements and cancelled checks. Even if this allegation is true, it does not excuse Rogers from failing to fulfill her duties under §4–406(a) & (c) because the statute clearly states a bank discharges its duty in providing the necessary information to a customer when it ‘‘sends … to a customer a statement of account showing payment of items.’’ §4–406(a) (emphasis added). [Citation.] The word ‘‘receive’’ is absent. The customer’s duty to inspect and report does not arise when the statement is received, as Rogers claims; the customer’s duty to inspect and report arises when the bank sends the statement to the customer’s address. A reasonable person who has not received a monthly statement from the bank would promptly ask the bank for a copy of the statement. Here, Rogers claims that she did not receive numerous statements. We find that she failed to act reasonably when she failed to take any action to replace the missing statements.

B. Rogers’ Duty to Report the Forgeries under §4–406(d).

A customer who has not promptly notified a bank of an irregularity may be precluded from bringing certain claims against the bank:

(d) If the bank proves that the customer failed, with respect to an item, to comply with the duties imposed on the customer by subsection (c), the customer is precluded from asserting against the bank:

(1) The customer’s unauthorized signature … on the item, if the bank also proves that it suffered a loss by reason of the failure; …

[UCC] §4–406(d)(1).

Also, when there is a series of forgeries, §4–406(d)(2) places additional duties on the customer:

(2) The customer’s unauthorized signature … by the same wrongdoer on any other item paid in good faith by the bank if the payment was made before the bank received notice from the customer of the unauthorized signature … and after the customer had been afforded a reasonable period of time, not exceeding thirty (30) days, in which to examine the item or statement of account and notify the bank.

A bank may shorten the customer’s thirty-day period for notifying the bank of a series of forgeries, and here, Union Planters shortened the thirty-day period to fifteen days. The statute states that a customer must report a series of forgeries within ‘‘a reasonable period of time, not exceeding thirty (30) days.’’ ‘‘The 30-day period is an outside limit only. However 30 days is presumed to be reasonable and the bank bears the burden of proving otherwise.’’ [Citation.]

Although there is no mention of a specific date, Rogers testified that she and her son began looking for the statements in late May or early June of 2001, after her husband had died. Her son felt that it was prudent to consolidate some of the five bank accounts. When they discovered that statements were missing, they notified Union Planters in June of 2001 to replace the statements. At this time, no mention of possible forgery was made, even though Neal, Jr., thought that ‘‘something was wrong.’’ In fact, Neal, Jr., had felt that something was wrong as far back as December of 2000, but failed to do anything. Neal, Jr., testified that neither he nor his mother knew that Reese had been forging checks until September of 2001. Courts in Louisiana and Texas have held that, under similar circumstances, a customer’s claims against a bank for paying forged checks are without merit. [Citations.]

Rogers is therefore precluded from making claims against Union Planters because (1) under §4–406(a), Union Planters provided the statements to Rogers, and (2) under §4– 406(d)(2), Rogers failed to notify Union Planters of the forgeries within 15 and/or 30 days of the date she should have reasonably discovered the forgeries.

***

* * * [U]nder §4–406, Rogers is precluded from recovering amounts paid by Union Planters on any of the forged checks because she failed to timely detect and notify the bank of the unauthorized transactions and because she failed to show that Union Planters failed to use ordinary care in its processing of the forged checks. Therefore, we reverse the circuit court’s judgment and render judgment here that Rogers take nothing and that the complaint and this action are finally dismissed with prejudice.

Step by Step Answer:

Smith and Roberson Business Law

ISBN: 978-0538473637

15th Edition

Authors: Richard A. Mann, Barry S. Roberts