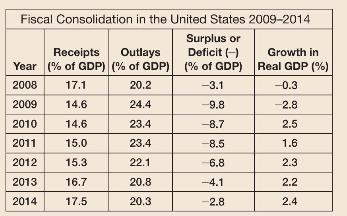

As seen in the following table, the crisis left the United States with an enormous federal budget

Question:

As seen in the following table, the crisis left the United States with an enormous federal budget deficit in 2009. There was a substantial fiscal consolidation from 2011 onward yet real output continued to grow.

a. Which played a larger role in the fiscal consolidation, raising taxes or reducing outlays?

b. In terms of the language of the text, if this fiscal consolidation were anticipated as of 2009 , was it "backloaded?" How might this help minimize the effects of the fiscal consolidation on output growth?

c. We know from Question 2 and from Chapters 4 and 6, that monetary policy maintained the nominal policy rate of interest of close to \(0 \%\) throughout this period and promised to maintain low interest rates into the future. How would this policy framework have helped the fiscal consolidation to take place without a decline in output?

d. The Federal Reserve introduced a target rate of inflation during the consolidation period on January 25, 2012. What is one advantage of introducing a policy where inflation is targeted at \(2 \%\) during a period of zero interest rates and fiscal consolidation?

e. We used the University of Michigan's Index of Consumer Sentiment in the previous chapter as a measure of expectations of households about the future. You can look at the values of this index at the FRED data base maintained by the Federal Reserve Bank of St. Louis (series UMCSENT1). Find this index and comment on its evolution from 2010 to 2014 as the fiscal consolidation proceeded.

Data from question 2

Consider these two quotes concerning recent Federal Reserve policy On December 12, 2012 the Federal Reserve issued the following statement: "In particular, the Committee decided to keep the target range for the federal funds rate at 0 to \(1 / 4\) percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6. 5 percent." On July 10, 2013, Ben Bernanke, Chairman of the Federal Reserve said: "There will not be an automatic increase in interest rate when unemployment hits \(6.5 \%\)."

Step by Step Answer: