Consider a withdrawal of ($ 500 0) from the Canadian banking system. Suppose all commercial banks have

Question:

Consider a withdrawal of \(\$ 500 0\) from the Canadian banking system. Suppose all commercial banks have a target reserve ratio of 8 percent and there is no cash drain.

a. Using a table like that shown in the previous question, show the change in deposits, reserves, and loans for the first three "rounds" of activity.

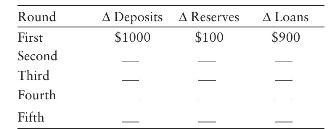

Data from in previous question

Consider a new deposit to the Canadian banking system of $1000. Suppose that all commercial banks have a target reserve ratio of 10 percent and there is no cash drain. The following table shows how deposits, reserves, and loans change as the new deposit permits the banks to "create" money.

b. Compute the eventual total change in deposits, reserves, and loans.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: