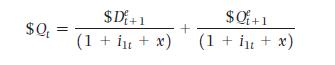

a. Explain why, in equation (14.14), it is important that the stock is ex-dividend, that is, it

Question:

a. Explain why, in equation (14.14), it is important that the stock is ex-dividend, that is, it has just paid its dividend and is expected to pay its next dividend in one year.

b. Using of equation (14.14), explain the contribution of each component to today's stock price.

c. If the risk premium is larger, all else being equal, what happens to the price of the stock today?

d. If the one-period interest rate increases, what happens to the price of the stock today?

e. If the expected value of the stock at the beginning of period \(t+1\) increases, what happens to the value of the stock today?

f. Now look carefully at equation (14.15). Set \(i_{1 t}=i_{1 t+n}=0.05\) for all \(n\). Set \(x=0.03\). Compute the coefficients on \(\$ D_{t+3}^{e}\) and \(\$ D_{t+10}^{e}\). Compare the effect of a \(\$ 1\) expected increase in a dividend 3 years from now and 10 years from now.

g. Repeat the computation in part \(\mathrm{f}\) with \(i_{1 t}=i_{1 t+n}=0.08\) for all \(n\) and \(x=0.05\).

Data from equation 14.14

Step by Step Answer: