A flexible exchange rate combined with a willingness to change the domestic interest rate can increase the

Question:

A flexible exchange rate combined with a willingness to change the domestic interest rate can increase the effectiveness of monetary policy in an open economy. Consider an economy that suffers a fall in business confidence (which tends to reduce investment).

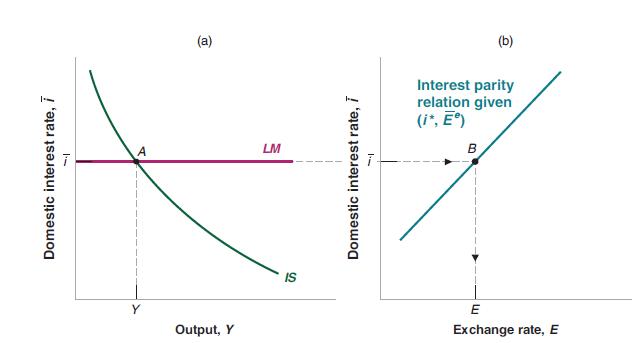

a. In an IS-LM-UIP diagram, such as Figure 19-2, show the short-run effect of the fall in business confidence on output and the exchange rate when the central bank leaves the interest rate unchanged. How does the composition of output change?

b. Suppose the central bank is willing to cut the interest rate to restore the level of output to its original value. How does this change the composition of output?

c. If the exchange rate was fixed and the central bank could not change the interest rate (remember, it is fixed at the foreign value \(i^{*}\) ), what policy options are left for the central bank?

d. Central banks generally favor flexible exchange rates. Explain why.

Data from Figure 19-2

Step by Step Answer: