Flexible exchange rates and the responses to changes in foreign macroeconomic policy Suppose there is an expansionary

Question:

Flexible exchange rates and the responses to changes in foreign macroeconomic policy Suppose there is an expansionary fiscal policy in the foreign country that increases \(Y^{*}\) and \(i^{*}\) at the same time.

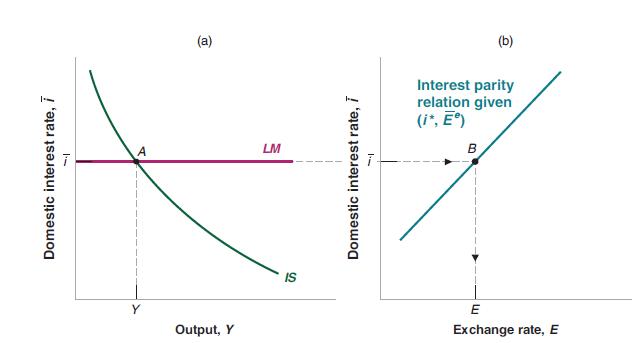

a. In an IS-LM-UIP diagram, such as Figure 19-2, show the effect of the increase in foreign output, \(Y^{*}\), and the increase in the foreign interest rate, \(i^{*}\), on domestic output \((Y)\) and the exchange rate \((E)\), when the domestic central bank leaves the policy interest rate unchanged. Explain in words.

b. In an IS-LM-UIP diagram, show the effect of the increase in foreign output, \(Y^{*}\), and the increase in the foreign interest rate, \(i^{*}\), on domestic output \((Y)\) and the exchange rate \((E)\), when the domestic central bank matches the increase in the foreign interest rate with an equal increase in the domestic interest rate. Explain in words.

c. In an IS-LM-UIP diagram, show the required domestic monetary policy following the increase in foreign output, \(Y^{*}\), and the increase in the foreign interest rate, \(i^{*}\), if the goal of domestic monetary policy is to leave domestic output \((Y)\) unchanged. Explain in words. When might such a policy be necessary?

Data from Figure 19-2

Step by Step Answer: