It was noted in the text that the Federal Reserve purchased, in addition to Treasury bills, large

Question:

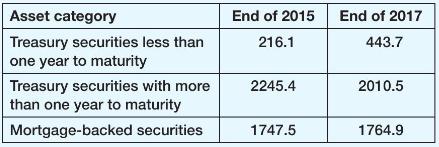

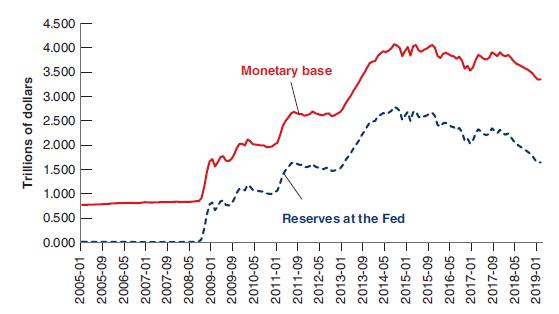

It was noted in the text that the Federal Reserve purchased, in addition to Treasury bills, large amounts of mortgage-backed securities and long-term government bonds as part of quantitative easing. Figure 23-2 shows that in 2015, there were about \(\$ 4\) trillion of assets in the monetary base. By 2018, total assets fell to \(\$ 3. 5\) trillion. The table below presents some further detail on three types of Federal Reserve assets in billions of dollars.

a. Why did the Federal Reserve Board buy the mortgagebacked securities?

b. Why did the Federal Reserve Board buy the long-term Treasury bonds?

c. What would you predict as the consequences of the following operation by the Federal Reserve Board: selling \(\$ 0.5\) trillion in mortgage-backed securities and buying \(\$ 0.5\) trillion in Treasury securities with less than one year to maturity?

d. What would you predict as the consequences of the following operation by the Federal Reserve Board: selling

\(\$ 0.5\) trillion in Treasury securities with maturity longer than one year and buying \(\$ 0.5\) trillion in Treasury securities with less than one year to maturity?

e. How did the Fed rearrange its balance sheet between 2015 and 2017? Is there evidence of unwinding of quantitative easing?

Data from Figure 23-2

Step by Step Answer: