Suppose the initial dividend paid by a stock is $10 per year. Let the interest rate and

Question:

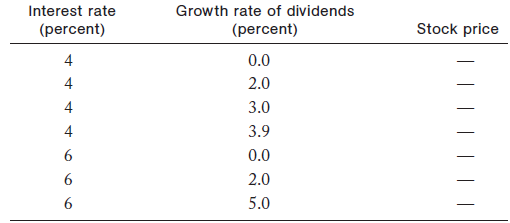

Suppose the initial dividend paid by a stock is $10 per year. Let the interest rate and the growth rate of dividends be given by the table below:

(a) For each case, compute the value of the stock according to the simple theory developed in the chapter.(b) What happens as the growth rate of dividends gets closer and closer to the interest rate? Why?(c) What does this imply about using a plot of the price-earnings ratio in the stock market to identify bubbles or the mispricing of individual stocks?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: