Holyrood Products Ltd makes DVD recorders. The management accountant has produced the following summary of the companys

Question:

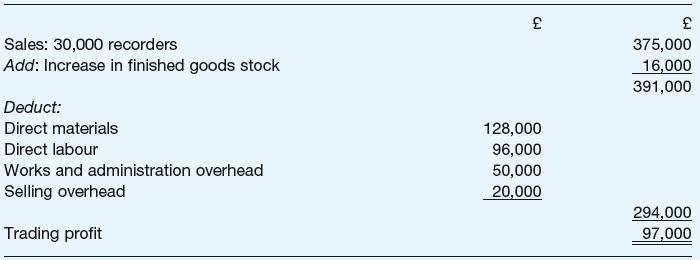

Holyrood Products Ltd makes DVD recorders. The management accountant has produced the following summary of the company’s trading in the year ended 30 June Year 3:

The following additional information is available:

(a) Works and administration overhead was 64% variable and 36% fixed, the latter including £2,500 for depreciation of plant surplus to current requirements.

(b) Selling overhead was 75% variable and 25% fixed.

(c) For management accounting purposes, finished goods stock is valued at variable cost excluding selling overhead.

(d) There was an increase of 2,000 units in finished goods stock over the year. The production manager has made the following estimates for the year to 30 June Year 4 which show that:

(a) The excess plant will be utilised for the production of calculators and digital watches in quantities of 5,000 and 10,000 respectively. The variable costs are:

(b) Finished goods stock of DVD recorders will remain unchanged and stocks of calculators and watches will be built up to 10% of production.

(c) Production of DVD recorders will be at the same level as that achieved in the year to 30 June Year 3.

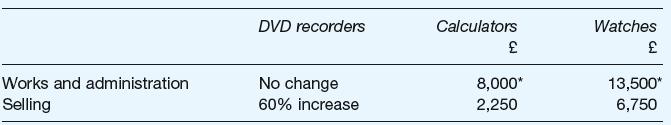

(d) Fixed overhead:

(e) Materials costs for DVD recorders will be increased by £1 per unit. Other variable costs will be held at the level attained in the year ended 30 June Year 3. The marketing director has advised that each product should be priced so as to achieve a 25% profit on total cost.

Required

Prepare a statement of budgeted profit for the year ended 30 June Year 4.

Step by Step Answer: