7.7 Brive plc has the following standards for its only product: Selling price: 110/unit Direct labour: 1

Question:

7.7 Brive plc has the following standards for its only product:

Selling price: £110/unit Direct labour: 1 hour at £10.50/hour Direct material: 3 kg at £14.00/kg Fixed overheads: £27.00/unit, based on a budgeted output of 800 units/month During May, there was an actual output of 850 units and the operating statement for the month was as follows:

£

Sales revenue 92,930 Direct labour (890 hours) (9,665)

Direct materials (2,410 kg) (33,258)

Fixed overheads ( 21,365 )

Operating profit 28,642 There were no inventories of any description at the beginning and end of May.

Required:

Prepare the original budget and a budget flexed to the actual volume. Use these to compare the budgeted and actual profits of the business for the month, going into as much detail with your analysis as the information given will allow.

#!#7.8 Varne Chemprocessors is a business that specialises in plastics. It uses a standard costing system to monitor and report its purchases and usage of materials. During the most recent month, accounting period six, the purchase and usage of chemical UK194 were as follows:

Purchases/usage: 28,100 litres Total price: £51,704 Because of fire risk and the danger to health, no inventories are held by the business.

UK194 is used solely in the manufacture of a product called Varnelyne. The standard cost specification shows that, for the production of 5,000 litres of Varnelyne, 200 litres of UK194 are needed at a total standard cost of £392. During period six, 637,500 litres of Varnelyne were produced.

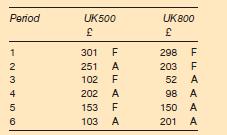

Price variances, over recent periods, for two other raw materials used by the business are:

where F = favourable variance and A = adverse variance.

where F = favourable variance and A = adverse variance.

Required:

(a) Calculate the price and usage variances for UK194 for period six.

(b) The following comment was made by the production manager:

‘I knew at the beginning of period six that UK194 would be cheaper than the standard cost specification, so I used rather more of it than normal; this saved £4,900 on other chemicals.’ What changes do you need to make in your analysis for

(a) as a result of this comment?

(c) Calculate, for both UK500 and UK800, the cumulative price variances and comment briefly on the results.

Step by Step Answer:

Management Accounting For Decision Makers

ISBN: 9781292072432

8th Edition

Authors: Dr Peter Atrill, Eddie McLaney