Acme Telephone Company (William Cotton) The Acme Telephone company is a supplier of telephone service to a

Question:

Acme Telephone Company (William Cotton)

The Acme Telephone company is a supplier of telephone service to a medium-sized community in the Northeastern United States. Scott White, the chief executive of Acme Telephone company, has just attended a trade exhibition entitled "Automate.

Emigrate, or Evaporate." As a result of what he learned at this exhibition, and also from scuttlebutt he has picked up from his peers in other companies, Scott is concerned about Acme 's ability to maintain its competitive position in the telecommunications market. Owing to deregulation in the telecommunications industry and the aggressive actions of new competitors in the local area, a significant number of Acme's customers have switched to other suppliers of telephone and related telecommunications service.

White feels that if Acme were to invest fully in new state-of-the-art fiber-optics technology as well as upgrade to the latest computer equipment, the loss of market share may be arrested, and operating efficiency may be improved. He contacted a leading vendor of fiber-optics systems and associated computer equipment to obtain information on operating characteristics and costs. This vendor would provide the necessary fiber-optics equipment, all associated installation costs, computer hardware, and initial software support for a total cost of $30,000,000.

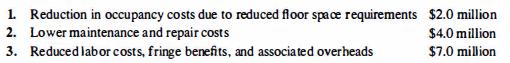

Although powerful and flexible, the new equipment is also compact, requiring much less space than the existing equipment. In addition, the equipment will require fewer people to operate and support it. Thus, additional benefits are realized by Solvings in occupancy and personnel support costs. The new equipment promises to be highly reliable and easy to maintain, and these attributes will lead to substantial savings in maintenance and repair costs. After White had consulted with his engineering and managerial accounting staff, the staff developed the following estimated annual cost of savings from implementing the new system:

The new equipment should also lead to reduced levels of working capital. Because of the vastly improved reliability of the new equipment, inventories of spares and repair equipment will be minimized. And the high-quality customer service will result in far fewer disputed customer accounts, so more customers will pay their bills on time. White expects a $5,000,000 reduction in inventory and accounts receivable, which, for simplicity of analysis, he assumes will occur about the time the new equipment is put into operation.

In addition to the outlay costs for hardware and software, White is aware that there are likely to be substantial in-house expenses related to the installation of the new technology.

The engineering and accounting staffs estimated $10,000,000 of one-time internal costs for implementing the new technology. These costs include the retraining of operating and maintenance personnel. For internal reporting purposes, the $10,000,000 internal costs will be capitalized along with the $30,000,000 purchase price when determining the investment required for the new proposal. In addition, the $ 10,000,000 internal costs will be amortized over the life of the project. For simplicity, it may be assumed that the $10,000,000 implementation cost is required at the same time as the $30,000,000 equipment purchase is made.

The vendor of the equipment requires an annual maintenance contract of $1,500,000 for the computer equipment, and the annual costs of maintaining and upgrading the software programs are assumed to average about $2,000,000. The vendor is adamant that all the equipment will have at least a 10-year useful life if it is properly maintained. The estimated disposal price of the equipment and software programs is $5,000,000 at the end of five years and $2,000,000 at the end of 10 years. In evaluating capital expenditures, Acme normally uses a discount rate of 16% and a maximum time horizon of five years. Acme does its investment evaluation on a pretax basis.

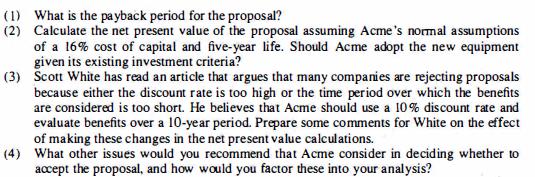

Scott White has marshaled all these data and wishes to evaluate the proposed investment in the new technology. In addition to the quantifiable data, White knows that some difficult-to-quantify benefits from the new technology are not included in the analysis, and he is unsure how they should be handled.

Required

Step by Step Answer:

Advanced Management Accounting

ISBN: 9780132622882

3rd Edition

Authors: Robert S. Kaplan, Anthony A. Atkinson, Kaplan And Atkinson