(Adapted from CPA May 1993) Budget preparation, break-even point, what-if analysis with multiple products The following budget...

Question:

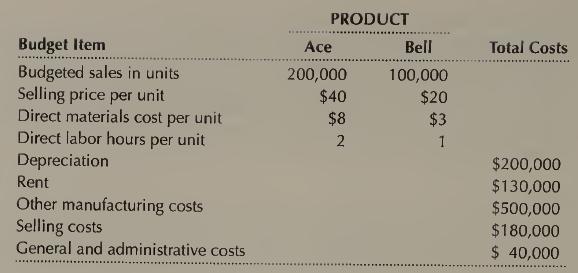

(Adapted from CPA May 1993) Budget preparation, break-even point, what-if analysis with multiple products The following budget information for the year ending December 31, 1999, pertains to Rust Manufacturing Company's operations:

The following information is also provided.

(a) Rust has no beginning inventory. Production is planned so that it will equal the number of units sold.

(b) The cost of direct labor is $5 per hour.

(c) Depreciation and rent are fixed costs within the relevant range of produc¬ tion. Additional costs would be incurred for extra machinery and factory space if production is increased beyond current available capacity.

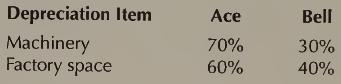

(d) Rust allocates depreciation proportional to machinery use and rent propor¬ tional to factory space. Budgeted usage is as follows:

(e) Other manufacturing support costs include flexible costs equal to 10% of direct labor and also include various capacity-related costs. None of the miscellaneous capacity-related manufacturing support costs depend on the level of activity, although support costs attributable to a specific product are avoidable if that product's production ceases. Other manufacturing support costs are allocated between Ace and Bell based on a percent of budgeted direct labor.

(f) Rust's selling and general administrative costs are fixed in the intermediate term.

(g) Rust allocates selling costs on the basis of a number of units sold at Ace and Bell.

(h) Rust allocates general and administrative costs on the basis of sales rev¬ enue.

REQUIRED

(a) Prepare a schedule, using separate columns for Ace and Bell, showing bud¬ geted sales, flexible costs, contribution margin, fixed (capacity-related) costs, and pretax operating profit for the year ending December 31,1999.

(b) Calculate the contribution margin per unit and the pretax operating profit per unit for Ace and for Bell.

(c) Calculate the effect on pretax operating profit resulting from a 10% de¬ crease in sales and production of each product.

(d) What may be a problem with the above analysis?(LO 8)

Step by Step Answer:

Management Accounting

ISBN: 9780130101952

3rd Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, S. Mark Young, Rajiv D. Banker, Pajiv D. Banker