Amsterdam Digitizers Amsterdam Digitizers (AD) is a relatively new Dutch firm in the telecommunication industry. It produces

Question:

Amsterdam Digitizers Amsterdam Digitizers (AD) is a relatively new Dutch firm in the telecommunication industry. It produces memory cards for end user products, like cameras and GPS systems. The current financial position is not bad, but AD management wants to improve it considerably. It has developed three alternative strategic scenarios.

The first scenario is called ‘Product Quality’. AD aims at improving quality by putting additional effort of production personnel in producing the products, leading to a 20%

increase in direct labour costs. It is also planning to make the production equipment more up to date by investing extra in manufacturing equipment, which leads to a yearly increase in fixed production costs of €25 000. Higher quality should cost more to the customer, hence AD wants to increase selling price by €0.50. AD expects this scenario to lead to 10% higher sales quantity.

An alternative approach is to start a ‘Marketing Campaign’ by lowering the selling price to

€6.40 and by motivating the sales force to put extra effort in approaching customers. To this end, AD will increase the sales persons' commissions to 15% of sales. It also wants to invest in additional publicity by adding €10 000 to the fixed sales expenses. This scenario should generate 15% additional sales quantity.

The third alternative strategy is labelled ‘Product Innovation’. AD has the option to introduce a renewed memory card, using more expensive materials and innovated production processes. The machinery needs replacement, which will lead to an annual additional amount of €40 000 fixed manufacturing costs. The material costs will double, while the variable overhead costs will be four times higher, at €2 per piece. Labour is not yet familiar with the new production process, which means that direct labour costs are estimated at €1.25 per piece.

Since it will be a new product, AD does not expect a large impact on sales quantity: only a 5% increase for next year.

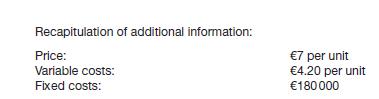

Current sales numbers are 80 000 units, price is €7. Material variable costs is €2 per unit, fixed manufacturing costs are €100 000. Direct labour costs are €1 per unit and variable overhead is €0.50 per unit. Fixed overhead costs is €50 000 for sales and €30 000 for administration.

AD has sales people taking care of customer relations and direct sales. Each sales person receives a 10% commission on sales revenues. Tax rate is 35%.

Required:

1. Make a pro forma income statement in Excel based on the current situation for Amsterdam Digitizers. Make a distinction between a Data Section (in which the most relevant given data are stored) and a Pro Forma Income Statement. What is AD's current net income?

2. Produce a systematic overview of the financial implications of each of the alternative strategies proposed by AD. Make use of Excel's scenario feature. You can find this feature under \Extra.

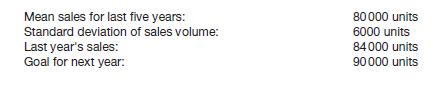

After having reviewed all options, AD's management decides not to change the strategy. They prefer to capitalise on the market strengths the company already posesses. The following market information may be relevant:

3. What is the probability of at least breaking even?

4. What is the probability of achieving next year's sales goal?

5. Suppose AD's management has reviewed the statistical information and it comes to the conclusion that the standard deviation is 12 000. How does this change your answer to questions 4 and 5?

Step by Step Answer: