An oil company has recently acquired rights in a certain area to conduct surveys and geological test

Question:

An oil company has recently acquired rights in a certain area to conduct surveys and geological test drillings that may lead to extracting oil where it is found in commercially exploitable quantities.

The area is already considered to have good potential for finding oil in commercial quantities. At the outset the company has the choice to conduct further geological tests or to carry out a drilling programme immediately. On the known conditions, the company estimates that there is a $70 \%$ chance of further tests indicating that a significant amount of oil is present.

Whether the tests show the possibility of oil or not, or even if no tests are undertaken at all, the company could still pursue its drilling programme or alternatively consider selling its rights to drill in the area.

Thereafter, however, if it carries out the drilling programme, the likelihood of final success or failure in the search for oil is considered dependent on the foregoing stages. Thus:

(i) If the tests indicated that oil was present, the expectation of success in drilling is given as $80 \%$.

(ii) If the tests indicated that there was insufficient oil present, then the expectation of success in drilling is given as $20 \%$.

(iii) If no tests have been carried out at all, the expectation of finding commercially viable quantities of oil is given as $55 \%$.

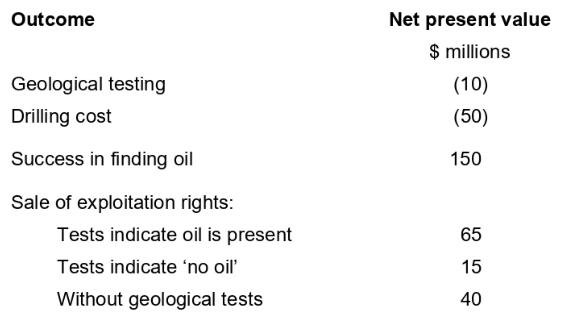

Costs and revenues have been estimated for all possible outcomes and the net present value of each is given below:

Required:

(a) Prepare a decision tree diagram to represent the above information.

(b) For the management of the company, calculate its best course of action.

(c) Explain the value of decision trees in providing management with guidance for decision making. Illustrate examples of any situations where you consider their use would be of benefit.

Step by Step Answer: