An owner has $200,000 to invest in a new restaurant. Equipment and furniture are to be purchased

Question:

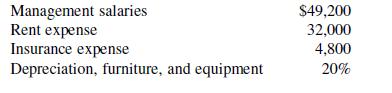

An owner has $200,000 to invest in a new restaurant. Equipment and furniture are to be purchased for $160,000, and $40,000 will be used for initial working capital. First-year estimates anticipate variable costs as a percentage of sales revenue and food costs at 35 percent, variable wage costs at 30 percent, and other variable costs of 15 percent. Other fixed and semifixed costs estimates are as follows:

The owner wants a 15 percent operating income (before tax) on his initial investment. As an alternative, the owner is considering borrowing $60,000 from a bank at a 10 percent interest rate instead of using his own money for the investment. Rather than purchasing $40,000 of the needed equipment, it would be rented at a cost of $10,000 per year.

Analyze each alternative, (1) using invested capital or (2) borrowing $60,000, and renting some of the equipment. Calculate the annual sales revenue needed to provide operating income (before tax) of 15 percent of the initial investment. Recommend to the owner how to finance the operation.

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471092223

8th Edition

Authors: Martin G Jagels, Michael M Coltman