Appendix Colway Company estimates the relation between the demand for its LO 3 products and the price

Question:

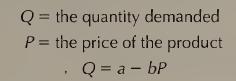

Appendix Colway Company estimates the relation between the demand for its LO 3 products and the price it sets, in terms of this equation where:

The marketing manager, Trisha Colway, conducted a market research study in fall 1999 that indicated that b = 500 and a = 8400 on average for the first quarter of 2000.

Capacity costs are m = $3.00 per unit and variable costs are v= $8.10 per unit. If committed capacity is exceeded, the variable costs increase to w = $12.70 per unit.

Trisha determined that the long-term benchmark price is given by this:

Trisha also set the capacity level at X = 2150 units.

Colway Company keeps track of demand conditions throughout the quarter. It announces a new price for each week in the Sunday-morning newspaper based on the most current information it has on demand conditions. The following are the estimates of the demand parameter for each of the 13 weeks in the first quarter of 2000.

The estimate of b remained at b = 500 for all 13 weeks. The short-term (weekly) price is set at this if the capacity is not exceeded by the realized demand:

the resultant demand will not exceed the capacity X = 2150 only if this occurs:

REQUIRED

(a) Determine the weekly prices, plot them on a graph for each of the 13 weeks, and compare them with the long-term benchmark price. What is the average of the weekly prices?

(b) Determine the total profit over the 13-week period. Repeat the same exercise after setting the capacity (X) at different levels (X = 1750, 1950, 2350, 2550). Plot the total profit on a graph against different levels of capacity that you select.(LO 2, 3)

Step by Step Answer:

Management Accounting

ISBN: 9780130101952

3rd Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, S. Mark Young, Rajiv D. Banker, Pajiv D. Banker