Auditors for Canada Revenue Agency (CRA) scrutinize income tax returns after they have been prescreened with the

Question:

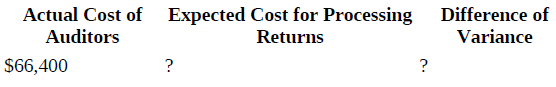

Auditors for Canada Revenue Agency (CRA) scrutinize income tax returns after they have been prescreened with the help of computer tests for normal ranges of deductions claimed by taxpayers. CRA uses an expected cost of $7 per tax return, based on measurement studies that allow 20 minutes per return. Each agent has a workweek of 5 days of 8 hours per day. Twenty auditors are employed at a salary of $830 each per week. The audit supervisor has the following data regarding performance for the most recent 4-week period, when 8,000 returns were processed:

1. Compute the planned cost and the variance.

2. The supervisor believes that audit work should be conducted more productively and that superfluous personnel should be transferred to field audits. If the foregoing data are representative, how many auditors should be transferred?

3. List some possible reasons for the variance.

4. Describe some alternative cost drivers for processing income tax returns.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu