Blackarm Inc. makes three products and is reviewing the profitability of its product line. You are given

Question:

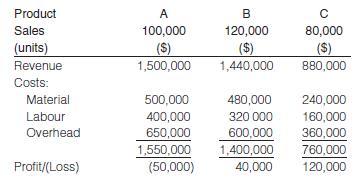

Blackarm Inc. makes three products and is reviewing the profitability of its product line. You are given the following budgeted data about the firm for the coming year.

The company is concerned about the loss on product A. It is considering ceasing production of it and switching the spare capacity of 100,000 units to Product C.

You are told:

(i) All production is sold.

(ii) Twenty-five per cent of the labour cost for each product is fixed in nature.

(iii) Fixed administration overheads of $900,000 in total have been apportioned to each product on the basis of units sold and are included in the overhead costs above. All other overhead costs are variable in nature.

(iv) Ceasing production of product A would eliminate the fixed labour charge associated with it and one-sixth of the fixed administration overhead apportioned to product A.

(v) Increasing the production of product C by 100,000 units would mean that the fixed labour cost associated with product C would double, the variable labour cost would rise by 20 per cent and its selling price would have to be decreased by $1.50 in order to achieve the increased sales.

Required:

(a) Prepare a marginal/incremental cost statement for a unit of each product on the basis of:

(i) the original budget (ii) if product A is deleted.

(b) Prepare a statement showing the total contribution and profit for each product group on the basis of:

(i) the original budget (ii) if product A is deleted.

(c) Using your results from

(a) and

(b) advise whether product A should be deleted from the product range, giving reasons for your decision

Step by Step Answer:

Management Accounting For Business

ISBN: 9781138550650

8th Edition

Authors: Colin Drury, Mike Tayles