Four years ago a computer system was installed by a life assurance company. AB Ltd, to support

Question:

Four years ago a computer system was installed by a life assurance company. AB Ltd, to support their administrative functions. The total capital cost was £47,000. A life of nine years was estimated for the system with a residual value of

£2,000. It has a book value now of £27,000, after charging

£5,000 annual depreciation.

With the increase in computer processing capabilities it is now apparent that a new and improved system can be bought for £40,000. This new system is likely to save £11,400 annually in staff costs and the expenses of a computer bureau. It will last for five years and is expected to sell for £5,000 after that time. The old system will be taken over by the company installing the new system, at a trade-in value of £10,000.

The general manager of AB Ltd is hesitant about the deal.

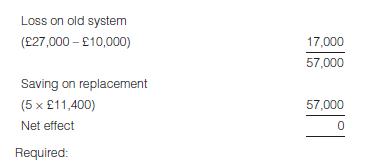

He has declared his views on the replacement as follows: ‘I can never agree to dispose of an asset at a loss before the end of its useful life. It always makes sense to use an asset until you get your money out of it.’ To further support his point he produced the following summary claiming to show the system produced no benefit:

(a) Prepare a financial summary which will show the difference in profit if the replacement goes ahead. Take all five years together and ignore the time value of money.

(b) Prepare a statement to show how profits for each of the next five years would change.

(c) Comment on the manager’s schedule and the views he has stated.

Step by Step Answer:

Management Accounting For Business

ISBN: 9781138550650

8th Edition

Authors: Colin Drury, Mike Tayles