Capacity and pricing decision Hudson Hydronics, Inc. is a corporation based LO 1, 2 in Troy, New

Question:

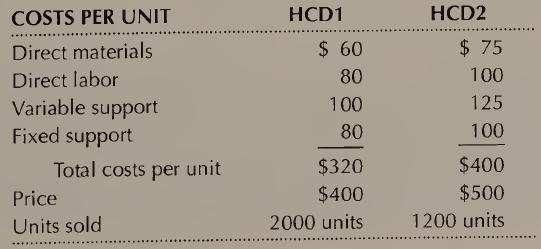

Capacity and pricing decision Hudson Hydronics, Inc. is a corporation based LO 1, 2 in Troy, New York, that sells high-quality hydronic control devices. It manufac¬ tures two products, HCD1 and HCD2, for which the following information is available:

The average wage rate including fringe benefits is $20 per hour. The plant has a capacity of 15,000 direct labor hours, but current production uses only 14,000 direct labor hours of capacity.

REQUIRED

(a) A new customer has offered to buy 200 units of HCD2 if Hudson lowers \ti price to $400 per unit. How many direct labor hours will be required to pro¬ duce 200 units of HCD2? How much will Hudson Hydronic's profit increase or decrease if it accepts this proposal? (All other prices will remain as be¬ fore.)

(b) Suppose the customer has offered instead to buy 300 units of HCD2 at $400 per unit. How much will the profits increase or decrease if Hudson accepts this proposal? Assume that the company cannot increase its production ca¬ pacity to meet the extra demand.

(c) Answer the question in

(b) above, assuming instead that the plant can work overtime. Direct labor costs for the overtime production increase to only $30 per hour. Variable support costs for overtime production are 50% more than for normal production.(LO 2, 3)

Step by Step Answer:

Management Accounting

ISBN: 9780130101952

3rd Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, S. Mark Young, Rajiv D. Banker, Pajiv D. Banker