Consider the following details of the income statement of the Pocket Calculator Division (PCD) of the Kim

Question:

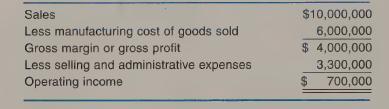

Consider the following details of the income statement of the Pocket Calculator Division (PCD) of the Kim Electronics Company for the year ended December 31, 2006:

PCD’s fixed manufacturing costs were $2.4 million and its fixed selling and administrative costs were $2.5 million. Sales commissions of 3 percent of sales are included in selling and administrative expenses.

The company sold 2 million calculators. Near the end of the year, Pizza Hut Corporation offered to buy 150,000 calculators on a special order. To fill the order, a logo bearing the Pizza Hut emblem would have to be added to each calculator.

Pizza Hut intended to use the calculators in special promotions in early 2007.

Even though PCD had some idle plant capacity, the president rejected the Pizza Hut offer of $660,000 for the 150,000 calculators. He said: “The Pizza Hut offer is too low. We’d avoid paying sales commissions, but we’d have to incur an extra cost of $0.20 per calculator to add the logo. If PCD sells below its regular selling prices, it will begin a chain reaction of competitors price-cutting and of customers wanting special deals. I believe in pricing at no lower than 8 percent above our full costs of $9,300,000 + 2,000,000 units = $4.65 per unit plus the extra $0.20 less the savings in commissions.”

1. Using the contribution approach, prepare an analysis similar to that in Exhibit 8-3. Use three columns: without the special order, the special order (total and per unit), and totals with the special order.

2. By what percentage would operating income increase or decrease if the order had been accepted? Do you agree with the president’s decision?

Why?

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas