Deleting a segment The original budget for the K department of Hilton Ltd for the forthcoming year

Question:

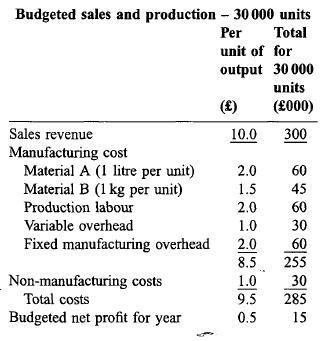

Deleting a segment The original budget for the K department of Hilton Ltd for the forthcoming year was as follows:

As part of Hilton's long-term strategic plan the K department was due to be closed at the end of the forthcoming year. However, rumours of the closure have resulted in the majority of K's labour force leaving the firm and this has forced the abandon- ment of the original budget for the department. The managing director has suggested that the department could be closed down immediately or, by employing contract labour, could be operated to produce 10000 or 20000 units in the year. With the exception of the foreman (see Note (v)), the few remaining members of K's production labour force would then be redeployed within the firm. The following further information is available: (i) Each hour of contract labour will cost 3.00 and will produce one unit of the product. Contract labour would have to be trained at a fixed cost of 20 000. (ii) There are 30 000 litres of material A in stock. This material has no other use and any of it not used in department K will have to be disposed of. Costs of disposal will be 2000 plus 0.50 per litre disposed of. (iii) There are 15 000 kg of material B in stock. If the material is not used in department K then up to 10000 kg could be used in another department to substitute for an equivalent weight of a material which currently costs 1.8 per kg. Material B originally cost 1.5 per kg and its current market price (buying or selling) is 2.0 per kg. Costs to Hilton of selling any surplus material B will amount to 1.00 per kg sold. (iv) Variable overheads will be 30% higher, per unit produced, than originally budgeted. (v) Included in 'Fixed manufacturing overheads' are

(a) 6000 salary of the departmental foreman,

(b) 7000 depreciation of the machine used in the department. If the department is closed immediately the foreman, who will otherwise retire at the end of the year, will be asked to retire early and paid 2000 compensation for agreeing to this. The only machine used in the department originally cost 70 000 and could currently be sold for 43 000. This sales value will reduce to 40 000 at the end of the year and, if used for any production during the year, will decrease by a further 500 per 1000 units produced. (vi) All other costs included in 'Fixed manufacturing overhead' and all 'Non- manufacturing costs' are apportionments of general overheads, none of which will be altered by any decision concerning the K department. (vii) The sales manager suggests that a sales volume of 10 000 units could be achieved if the unit sales price were 9.00. A sales volume of 20 000 units would be achieved if the sales price per unit were reduced to 8 and an advertising campaign costing 15000 were undertaken. Required:

(a) Advise Hilton Ltd of its best course of action regarding department K, presenting any data in tabular form.

(b) Show how the advice given in

(a) above is altered if the closure of department K would enable its factory space to be rented out for one year at a rental of 8000.

Step by Step Answer: