Relevant costs for a pricing decision Johnson trades as a chandler at the Savoy Marina. His profit

Question:

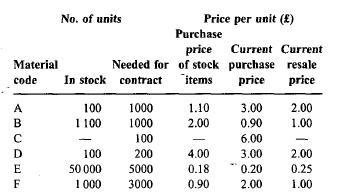

Relevant costs for a pricing decision Johnson trades as a chandler at the Savoy Marina. His profit in this business during the year to 30 June was 12000. Johnson also undertakes occa- sional contracts to build pleasure cruisers, and is considering the price at which to bid for the contract to build the Blue Blood for Mr B.W. Dunn, delivery to be in one year's time. He has no other contract in hand, or under consideration, for at least the next few months. Johnson expects that if he undertakes the contract he would devote one-quarter of his time to it. To facilitate this he would employ G. Harri- son, an unqualified practitioner, to undertake his book-keeping and other paperwork, at a cost of 2000. He would also have to employ on the contract one supervisor at a cost of 11 000 and two crafts- men at a cost of 8800 each; these costs include Johnson's normal apportionment of the fixed over-heads of his business at the rate of 10% of labour cost. During spells of bad weather one of the crafts- men could be employed for the equivalent of up to three months full-time during the winter in main- tenance and painting work in the chandler's busi- ness. He would use materials costing 1000. Johnson already has two inclusive quotations from jobbing builders for this maintenance and painting work, one for 2500 and the other for 3500, the work to start immediately. The equipment which would be used on the Blue Blood contract was bought nine years ago for 21000. Depreciation has been written off on a straight-line basis, assuming a ten-year life and a scrap value of 1000. The current replacement cost of similar new equipment is 60000, and is expected to be 66 000 in one year's time. Johnson has recently been offered 6000 for the equipment, and considers that in a year's time he would have little difficulty in obtaining 3000 for it. The plant is useful to Johnson only for contract work. In order to build the Blue Blood Johnson will need six types of material, as follows:

Materials B and E are sold regularly in the chand- ler's business. Material A could be sold to a local sculptor, if not used for the contract. Materials A and E can be used for other purposes, such as property maintenance. Johnson has no other use for materials D and F, the stocks of which are obsolete. The Blue Blood would be built in a yard held on a lease with four years remaining at a fixed annual rental of 5000. It would occupy half of this yard, which is useful to Johnson only for contract work. Johnson anticipates that the direct expenses of the contract, other than those noted above, would be 6500. Johnson has recently been offered a one-year appointment at a fee of 15000 to manage a boat- building firm on the Isle of Wight. If he accepted the offer he would be unable to take on the contract to build Blue Blood, or any other contract. He would have to employ a manager to run the chandler's business at an annual cost (including fidelity insurance) of 10000, and would incur additional personal living costs of 2000. You are required:

(a) to calculate the price at which Johnson should be willing to take on the contract in order to break even, based exclusively on the informa- tion given above; (15 marks)

(b) to set out any further considerations which you think that Johnson should take into account in setting the price at which he would tender for the contract. Ignore taxation.

Step by Step Answer: