Price/output and key factor decisions You work as a trainee for a small management consultancy which has

Question:

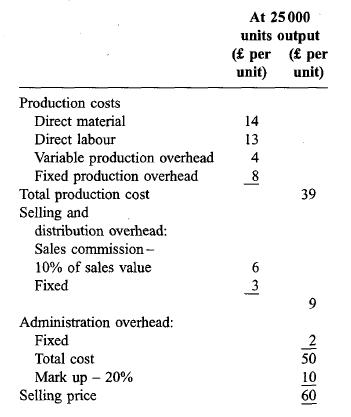

Price/output and key factor decisions You work as a trainee for a small management consultancy which has been asked to advise a company, Rane Limited, which manufactures and sells a single product. Rane is currently operating at full capacity producing and selling 25000 units of its product each year. The cost and selling price structure for this level of activity is as follows:

A new managing director has recently joined the company and he has engaged your organization to advise on his company's selling price policy. The sales price of 60 has been derived as above from a cost-plus pricing policy. The price was viewed as satisfactory because the resulting demand enabled full capacity operation. You have been asked to investigate the effect on _costs and profit of an increase in the selling price. The marketing department has provided you with the following estimates of sales volumes which could be achieved at the three alternative sales prices under consideration. Selling price per unit 70 80 90 Annual sales volume (units) 20 000 16000 11000 You have spent some time estimating the effect that changes in output volume will have on cost beha- viour patterns and you have now collected the following information. Direct material: The loss of bulk discounts means that the direct material cost per unit will increase by 15% for all units produced in the year if activity reduces below 15 000 units per annum. Direct labour: Savings in bonus payments will reduce labour costs by 10% for all units produced in the year if activity reduces below 20 000 units per annum. Sales commission: This would continue to be paid at the rate of 10% of sales price. Fixed production overhead: If annual output volume was below 20000 units, then a machine rental cost of 10000 per annum could be saved. This will be the only change in the total expenditure on fixed production overhead. Fixed selling overhead: A reduction in the part- time sales force would result in a 5000 per annum saving if annual sales volume falls below 24 000 units. This will be the only change in the total expenditure on fixed selling and distribu- tion overhead. Variable production overhead: There would be no change in the unit cost for variable produc- tion overhead. Administration overhead: The total expenditure on administration overhead would remain unal- tered within this range of activity. Stocks: Rane's product is highly perishable, therefore no stocks are held.

Task 1

(a) Calculate the annual profit which is earned with the current selling price of 60 per unit.

(b) Prepare a schedule to show the annual profit which would be earned with each of the three alternative selling prices. Task 2 Prepare a brief memorandum to your boss, Chris Jones. The memorandum should cover the follow- ing points:

(a) Your recommendation as to the selling price which should be charged to maximize Rane limited's annual profits.

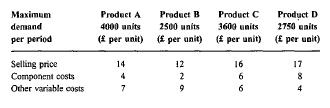

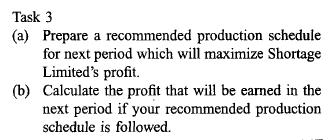

(b) Two non-financial factors which the manage- ment of Rane Limited should consider before planning to operate below full capacity. Another of your consultancy's clients is a manu- facturing company, Shortage Limited, which is experiencing problems in obtaining supplies of a major component. The component is used in all of its four products and there is a labour dispute at the supplier's factory, which is restricting the com- ponent's availability. Supplies will be restricted to 22 400 components for the next period and the company wishes to ensure that the best use is made of the available components. This is the only component used in the four products, and there are no alternatives and no other suppliers. The components cost 2 each and are used in varying amounts in each of the four products. Shortage Limited's fixed costs amount to 8000 per period. No stocks are held of finished goods or work in progress. The following information is available concern- ing the products.

Step by Step Answer: