Desteur Plastics Limited (DPL) manufactures a wide range of household plastic products for kitchens and bathrooms. The

Question:

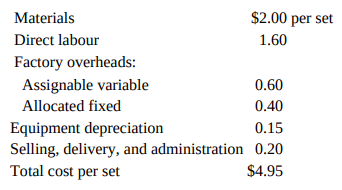

Desteur Plastics Limited (DPL) manufactures a wide range of household plastic products for kitchens and bathrooms. The company’s products are sold primarily to large retailers, including department stores, discount chains, and grocery chains. One of DPL’s products is a line of plastic dishware that is sold prepackaged as fourpiece place settings. DPL sells the dishes to retailers at $8 per set and has in recent years been operating at or near the limited capacity of the equipment, which is approximately 500,000 sets per year. The costs of producing the dishes have been determined by DPL’s bookkeeper as follows:

The selling, delivery, and administration costs are those that are identifiable with the product, and are essentially variable.

The equipment used for the dishes is old and substantially depreciated, and will have to be retired or replaced within the next two years. Its present book value is $130,000, although it would probably fetch only about $15,000 scrap value (or twice that on a trade-in). The equipment has no other uses within DPL.

A major grocery chain that is not a regular customer of DPL approached the company in late 2010 and offered to buy 700,000 sets per year for at least four years to use in special promotions commencing June 2011. The additional sets would be identical to DPL’s regular line, except that the packaging would bear the grocery chain’s name and teddy bear logo. The chain proposes to buy the special sets for $5 per set. They would be priced in the stores at two-thirds the price of the regular line.

Since DPL does not currently have the capacity to produce the additional sets, they would have to buy additional dish-making capacity if the company decides to accept the order. Rather than supplement the current capacity, DPL proposes to retire the old equipment and to buy new equipment that has triple the capacity of the old. This would allow for possible expansion of the regular line as well as provide the capacity for both the regular and the special dishes.

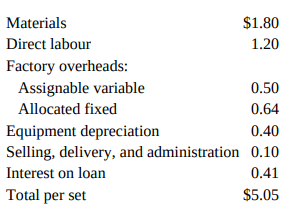

The DPL plant manager estimates that if the new equipment were purchased, the greater efficiency of the machine would permit a 10 percent savings in material cost and 25 percent savings in labour cost. Depreciation, however, would go from $0.15 per set to $0.40 per set, and there would also be the added cost of the interest on the loan to buy the new equipment. The bookkeeper has also pointed out that the fixed overhead allocation would increase because the allocation is based partially on the cost of the equipment in use. The estimated cost per set to produce the additional 700,000 sets is as follows:

The selling, delivery, and administration cost is less per set on the special 700,000 set order, but the cost of servicing the regular line would not change. The interest cost is 12 percent per annum on the $2,400,000 loan that would be required to purchase the new equipment, divided by the 700,000 additional sets. The total cost of the new equipment is $3,000,000. DPL’s cost of capital is 14 percent after income tax.

The new equipment would probably be purchased by means of a bank term loan with a five year term, although DPL would also be willing to consider a long-term lease arrangement through its bank’s leasing subsidiary. DPL’s fiscal year ends on December 31.

Required

Perform the necessary calculations to determine whether DPL should accept the offer for the 700,000 additional sets of dishes per year. Indicate what uncertainties exist and what qualitative factors are important in this decision. Assume a 40 percent tax rate and that the CCA rate for the new equipment is 30 percent for 2011. However, the rate will drop to 25 percent for 2012 and later years. The half-year rule applies.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu